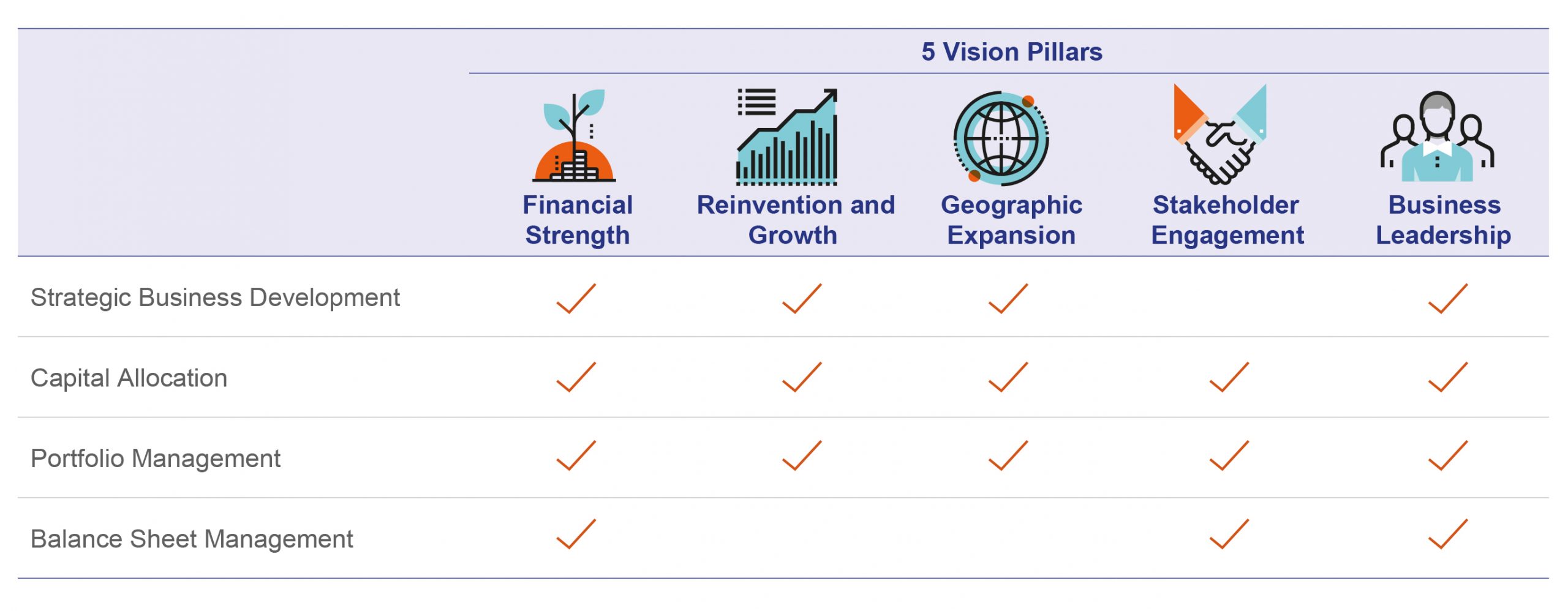

Ayala addresses structural and societal gaps in the Philippines by building impactful businesses and transforming its industry-leading subsidiaries. Our long-term value creation is driven by strategic business development, a robust capital allocation process, active portfolio, and balance sheet management, with sustainability at our core.

We have a strong track record of building

impactful businesses and steering their strategic transformation as industry-leading players. We identify opportunities in sectors that are either in nascent stages or are undergoing disruption to create strong franchises. We explore new sectors, geographies, and expert partners to develop new business models where we can innovate and unlock our unique advantage.

Our strategy execution is driven by four elements: Our strategic business development agenda continues to refine our existing business strategies and to identify new opportunities by leveraging our financial, intellectual, human, and social and relationship capital. Our robust capital allocation process utilizes quantitative and qualitative criteria and a multi-step management approach to fund new or existing businesses. We employ active portfolio management and continue to rebalance our holdings to crystalize value.

Finally, our active balance sheet management is the engine that allows us to stay nimble and drives our capacity to grow.

These four are done in the context of key global, regional, and local trends that we believe will impact markets, sectors, and businesses in which we choose to invest and operate.

Our management approach and constant reinvention has cemented our business leadership over the past 185 years. We are addressing the societal gaps through the company’s investment portfolios in healthcare, education, and infrastructure.

Our financial management strategy is rooted in discipline and a conscious alignment to the vision of Ayala to be the most relevant, innovative, and enduring business group. Using the five vision pillars as a guide, management gains a better understanding of how decisions on capital allocation, portfolio management, business development, and balance sheet management impact the overall strategy, allowing the company to be agile and ensure its longevity.

Strategic Business Development

In Ayala, we constantly look for new investment areas, identify opportunities, and assess emerging markets and economic trends. This process includes a thorough analysis of the performance of a business and weighing this against the competition, the business landscape, and the approved budget plan. The objective is to refine capital allocation depending on performance, and if needed, suggest changes to the business plans or strategies.

In November 2019, we invested US$237.5 million in Myanmar through a 20 percent ownership stake in the Yoma Group. Myanmar is among the ASEAN’s fastest growing economies but remains underpenetrated. This long-term investment in Myanmar supports our belief in the country’s growth potential and the prospects of the region in general. We partnered with the Pun family’s Yoma Group because they are a conglomerate of high regard and with values that align with ours.

All investment proposals that progress beyond the Corporate Strategy and Finance groups are presented to the Investment Committee. The Investment Committee is composed of Ayala’s key senior officers and may invite other senior group executives to provide insight. The Investment Committee then reviews the business plan and the strategy for execution. A thorough discussion on risks is carried out and responsible persons are identified to execute the business plan. If the Investment Committee approves the proposed investment, it is then endorsed to the Finance Committee of the Board.

Capital Allocation

In practice, investment decisions are weighed against whether they can deliver significant value over time. We follow a rigorous process that evaluates opportunities and tests for business and financial viability. Management provides the needed capital to the approved business plan and designates a responsible management team to carry out the implementation. Business performance is reviewed on a regular basis and our gating process involves many groups within the company, including Corporate Strategy and Development; Finance; a management-led Investment Committee; the Board’s Finance Committee; and the Board of Directors.

Portfolio Management

Our portfolio consists of companies in various stages of development. Our core businesses Ayala Land, BPI, Globe, and AC Energy are capital self-sufficient and have access to various sources of funding, while our emerging businesses rely on equity infusion from Ayala. As the emerging companies grow and become more profitable, they are able to access other avenues of funding. For its part, Ayala provides the critical support beyond equity capital including strategy, treasury, corporate finance, audit, legal, and human resources.

The Management Investment Committee and the Board’s Finance Committee review the performance of each business unit through a portfolio strategy cycle throughout the year. This starts with a Group CEO session to align on our outlook, then a portfolio review process to study our existing assets set against the current macroeconomic backdrop, regular deep dives on specific business units, and a review process to assess performance against annual targets. This robust process provides management the platform to assess whether to allocate more capital to a business or rebalance our holdings to solidify value.

Balance Sheet Management

Over the years, Ayala has built a portfolio of core businesses that served as sources for our operating expenses, interest obligations, and dividend expectations while enabling us to raise capital to fund new enterprises.

Our balance sheet is the engine that drives our capacity to grow. As such, we ensure that it remains strong with significant debt capacity and a well spread out maturity profile that gives us the flexibility to fund future growth opportunities. This is augmented by an optimal foreign exchange and interest rate mix and a healthy cashflow adequacy ratio.

Ayala’s loan to value ratio, which compares our net debt to the market value of our investments, is a good measure of our relative indebtedness and our capacity to take on or service our obligations. At the end of 2019, our loan to value ratio decreased to 6.5 percent from 11.8 percent in 2018. The decrease was largely attributed to the maturity of our US$300 million exchangeable bond in April 2019. The dividends Ayala received from AC Energy’s sale of thermal assets were also used to repay US$380 million from our bilateral facilities.

Our current loan to value ratio (LTV) remains low and indicates that for every ₱6.50 of debt we carry, we have ₱100 of assets behind it. The LTV does not include the impact of our fixed-for-life perpetual bonds as these are perpetual securities and do not have to be repaid. Gross debt increased to ₱105.8 billion, offset by an end-2019 cash balance, which brought net debt to ₱83.2 billion. At the parent level, net debt to equity ratio went down to 0.63 to 1.

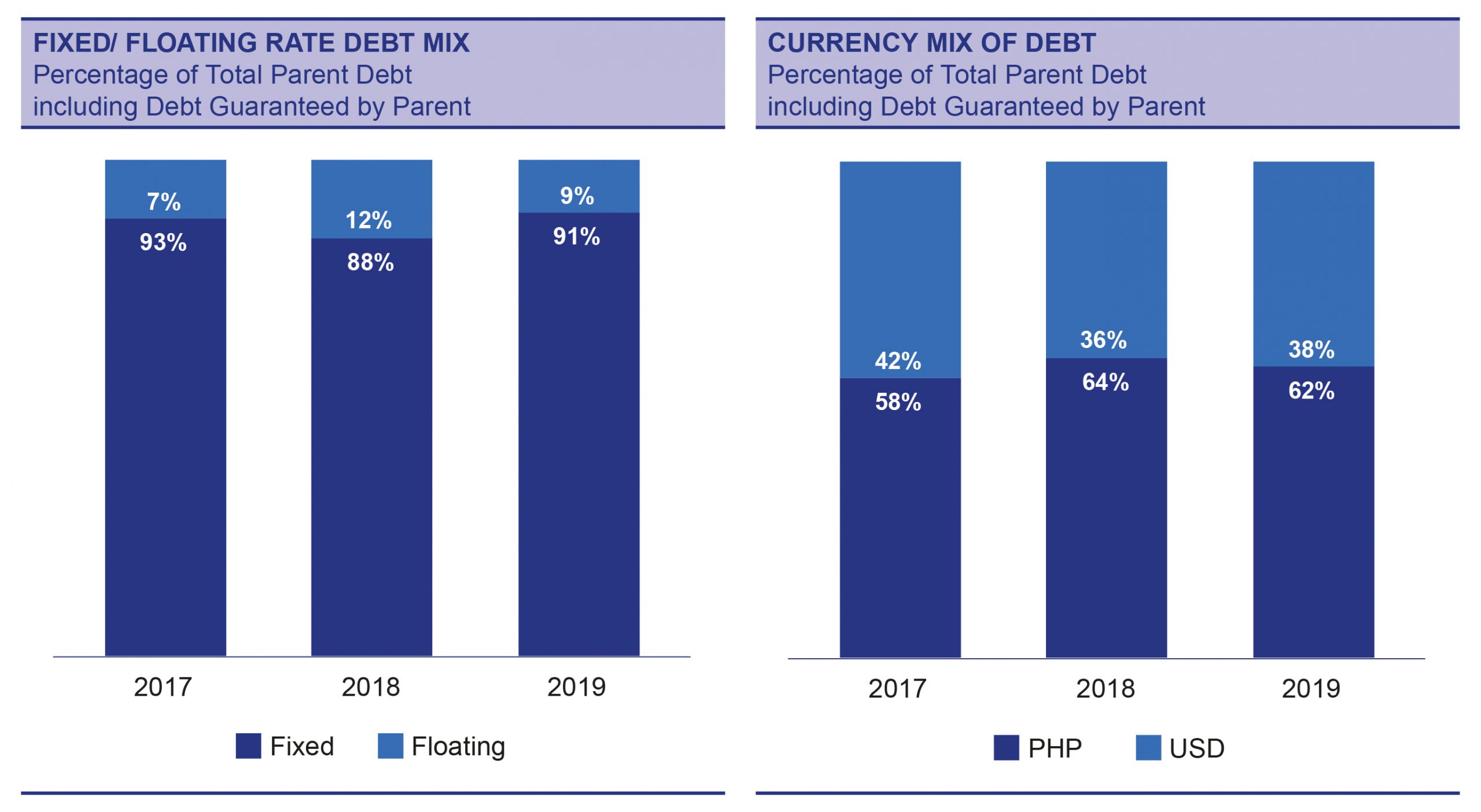

We continue to manage our obligations to ensure that we are not overly exposed to market liquidity, foreign exchange, and interest rate risks. Our average cost of debt rose slightly to 5.4 percent per annum following a period of rising interest rates in the first half of 2019. At year end, our debt maturities are well-spread out and in compliance with our internal policy of not having maturities exceeding 20 percent of total debt annually.

Our fixed to floating rate mix of 91/9 reflects our strategy of capitalizing on lower interest rates during the latter part of 2019 and puts Ayala in a favorable position in a rising rate environment. Peso obligations are 62 percent of our total obligations and our US dollar denominated obligations are more than offset by US dollar cash and long-term foreign currency investments.

Related to our investments on new growth ventures, we are confident in the long-term value creation of the company. In May 2019, we purchased 3.8 million of our common shares from Mitsubishi Corporation for ₱3.2 billion. On December 5, 2019, the Board approved a new buyback program and allocated ₱10 billion for the purchase of Ayala Corporation shares. We purchased 673,000 of our common shares for ₱545 million as of year end, reflecting our confidence amid challenging market conditions.

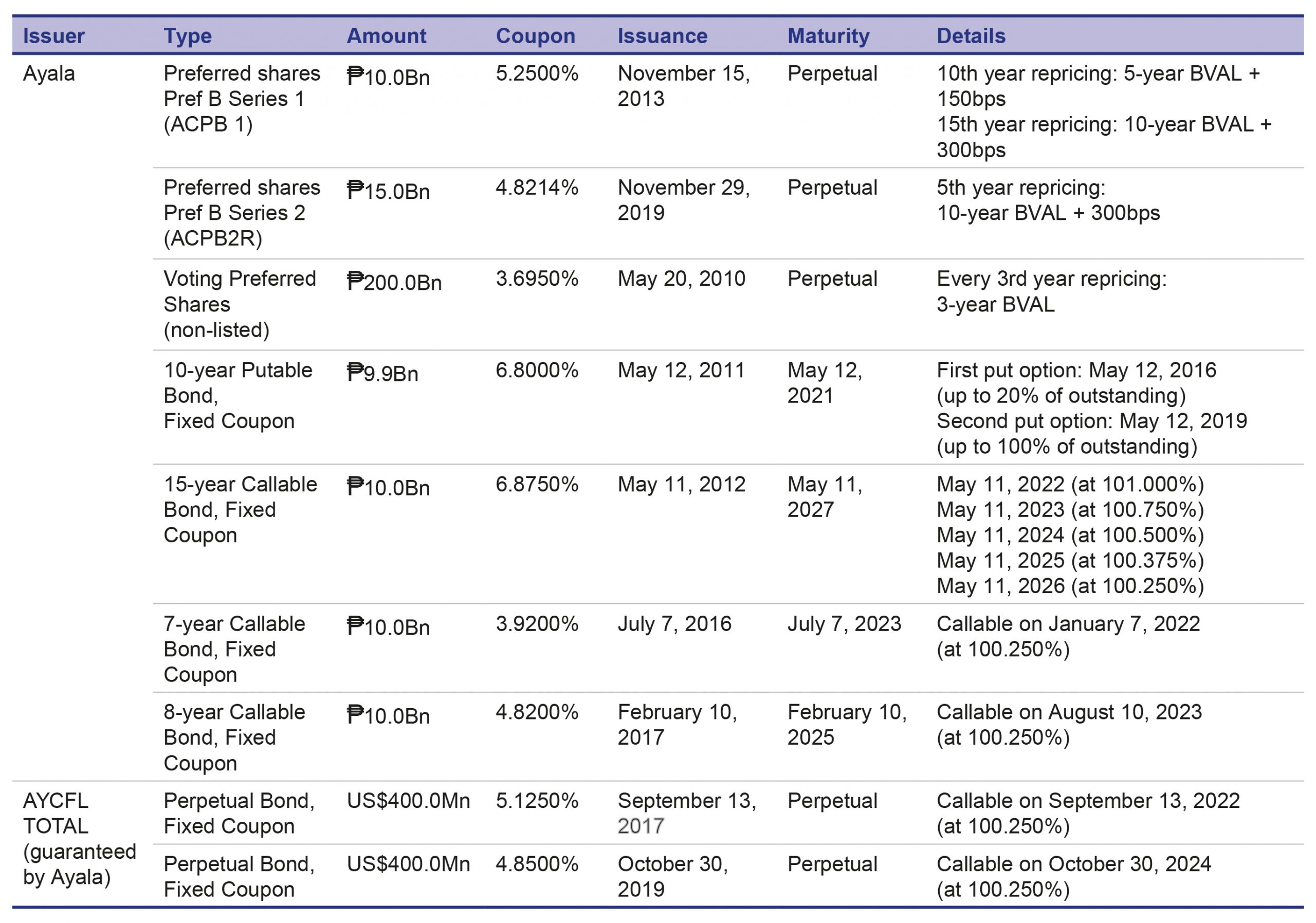

Our sound debt management practice allows us flexibility in our investment decisions. Our strategy as regards to debt is to raise debt opportunistically in the public markets and rely on strong and transparent banking relationships in the loan markets. In October 2019, the drop in interest rates provided an opportunity for Ayala to return to the international capital markets. We raised US$400 million from the issuance of a second fixed-for-life perpetual bond at a coupon of 4.85 percent. The offering was the second fixed-for-life notes issuance in Asia Pacific for 2019 and the lowest yielding of its kind out of Southeast Asia.

In November 2019, we tapped the domestic capital markets and raised ₱15 billion from our preferred shares issuance. Pricing was 60 basis points over the 5-year Bloomberg Valuation (BVAL) benchmark with a final computed rate of 4.8214 percent – the tightest for a preferred shares issuance. The offering was also the largest domestic fund-raising exercise done by Ayala in recent years, receiving the highest participation from the PSE trading participants in recent preferred share offers.

Our strong credit is shown in our capital raising and supported by wide access to bank loans. We maintain committed lines from both local and foreign banks that ensure we have sources of funds available when needed.

Our debt policies ensure that we can comfortably service our interest and operating expenses, meet maturing obligations, and have the confidence to face or take advantage of market downturns. The policies include:

1. Maintaining a pre-defined cash flow adequacy ratio, to ensure cash we receive at Ayala is sufficient to meet all our cash obligations arising from expenses, interest, and dividends.

2. Maintaining a maximum loan to value ratio, which measures the ratio of our net debt to the total value of our assets. Tracking this ratio daily provides management and the Board a measure as to how much of our value is funded by debt. It is also a tool during a market downturn, as it helps in decision-making whether we should sell assets to prune our debt levels or take on additional debt to buy undervalued assets.

3. Maintaining a maximum amount of debt due each year where our debt maturities are spread out across many years, to avoid concentration in a single year. This ensures that an external event that might affect refinancing in any given year does not cause significant problems.

4. Hedging is done if non-peso debt is used to fund peso investments. For prudence, foreign currency-denominated debt is used to finance foreign-currency-denominated investments.

5. Maintaining a minimum ratio of fixed rate loans to floating rate loans to ensure that our cost of capital carries a similar characteristic with

our long-term investments.

Share Price Performance

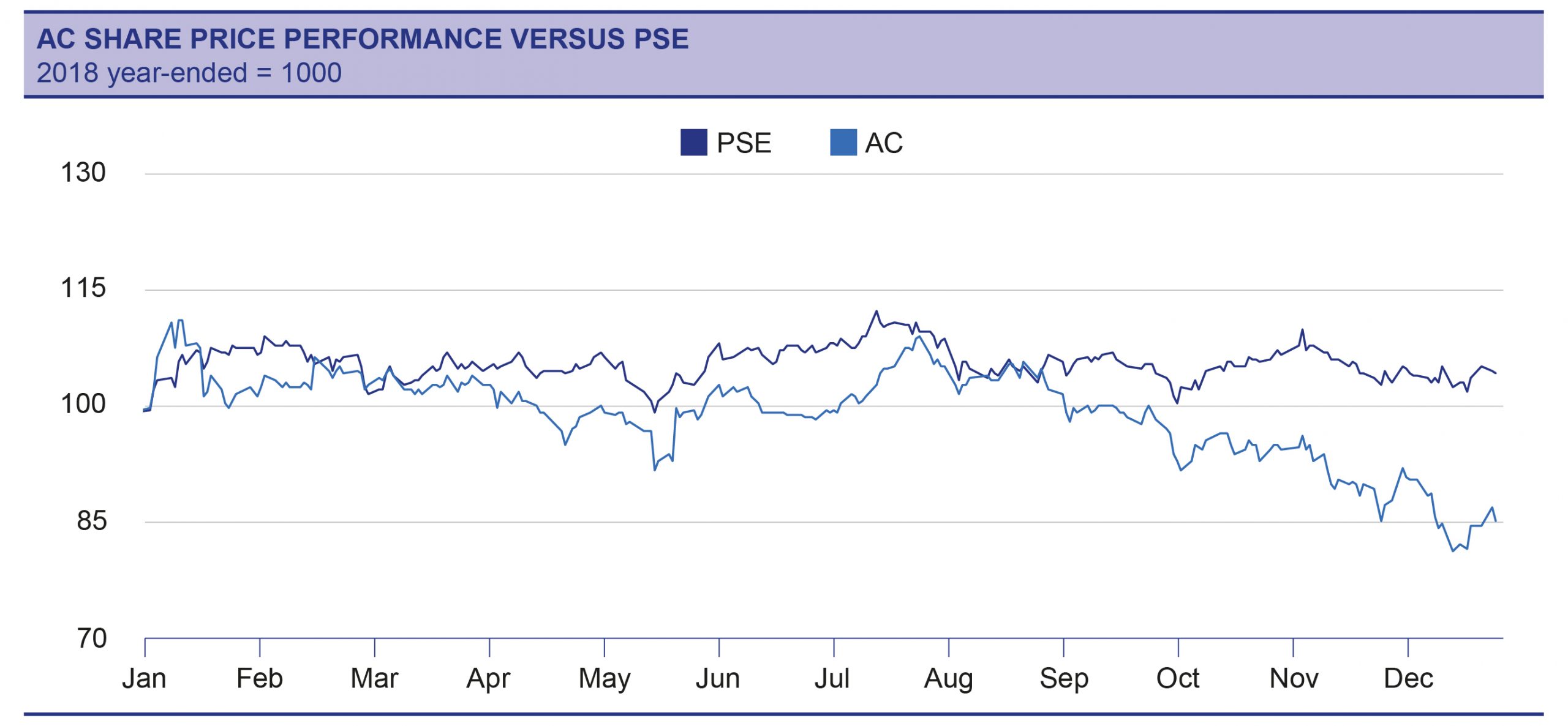

The Philippine economy as a whole was coming from a year of underperformance, and was expected to rebound in 2019 on the back of lower inflation rates and higher government spending. Coupled with the easing policy set forth by the then new BSP head Benjamin Diokno, outlook for the economy was widely positive. However, while inflation rates did drop to the target range of the government as early as the first quarter of the year and several rate cuts were implemented by the central bank, sentiment slowly deteriorated as internal and external headwinds weighed down GDP growth, which ended at 5.9 percent and below the government’s full year target of 6 percent to 6.5 percent. In particular, a delay in passage of the national budget hampered government spending in the first part of the year.

The PSEi was flattish throughout 2019 given these factors and registered a low-single digit growth by the end of the year. Ayala’s share price tracked the index’s movement for the most part, exhibiting alternating upswings and downswings for the first seven months during which it traded at an average of ₱910, near its start-of-the-year levels of ₱906. Amongst the most notable events that affected Ayala’s share price in that period happened in the first month of 2019 when the company was trading at its peak of nearly ₱1,000. In mid-January, Mitsubishi Corporation, the company’s second largest shareholder, sold AC shares worth ₱11.7 billion at ₱900 per share. Ayala’s volatile share price continued in February when MSCI announced that it would rebalance, in three tranches, towards China A shares. This effectively reduced weights of other component markets in the MSCI including the Philippines. The Ayala group also saw unfavorable sentiment due to the water supply shortage in March, which affected Manila Water and the temporary outage of banking services of BPI due to its system upgrade in April. Further, by the time first half earnings were reported in August, concerns on IMI’s worse than expected losses and Ayala Land’s residential sales performance became an added concern for investors, exacerbating the outlook for the parent company. The market also perceived AC Energy’s divestment gains from its sell down of some thermal plants a one-off and a reduction of the power company’s ability to generate core earnings.

By September, despite the strong results of BPI, Globe, and Ayala Land, Ayala started to lag versus the index, which sustained its flattish trajectory. As investors started to digest mid-year earnings, the company’s share price started to move downwards but it was not until November, around the same time the Yoma transaction was announced, that Ayala saw the biggest drop in value at the ₱850 level. The buy-in into the Myanmar-based company had mixed feedback from the investment community, leading to more uncertainty towards the group. In December, this was further amplified when the government threatened to revoke the contracts of the incumbent water concessionaires on the grounds of onerous provision in the deals, effectively also dampening sentiment in the country. While these were happening, concerns on the novel coronavirus was starting to emerge, establishing the storyline for perhaps the biggest global headwind for the incoming year. The PSEi ended 2019 at 7,815.26, up roughly 4.35 percent while Ayala’s share price tallied at ₱785.50, down 13.3 percent.

Dividends

Ayala’s policy is to provide a regular fixed semi-annual cash dividend to common shares. For voting preferred shares, the dividend rate is 5.77 percent per annum. For non-voting Preferred B Series 1 and Series 2 shares, the dividends are given at 5.25 percent and 4.82 percent per annum, respectively. It is the company’s policy to treat all shareholders equally, ensuring payment of dividends in an equitable and timely manner—within 30 days after being declared and finally cleared.

In 2019, we declared total dividends per common share of ₱8.30, 20 percent higher compared to the previous year. We understand that our shareholders view our dividends as a regular source of both income and capital returns and strive to maintain consistent distributions from year to year. Moving forward, we will continue to revisit potential sustainable increases in the regular dividend rate, with the continued capacity to make new or additional investments as the primary consideration.

Non-financial Management Strategy

The other component that defines the way we do business is our commitment to sustainability. Our non-financial management strategy revolves on human resource development with the belief that our employees are our primary customers and their welfare is our priority, corporate governance which makes sure that we comply with policies and regulations required of responsible companies, stakeholder management where we operate with the welfare of our stakeholders in mind, risk management which gives us the balance and cautions us as we keep our balance sheet strong, and brand management where our mindset is that everything we do affects our brand and reputation.

With these, Ayala annually looks at environmental, social, and governance performance as aligned with its Sustainability Reporting Framework. Moreover, Ayala also monitors how it creates shared value and ensures that it significantly contributes to the UN Sustainable Development Goals through the commitments set in the Ayala Sustainability Blueprint.

As our financial management strategy helps us be financially strong to grow and expand, our non-financial management strategy helps us ensure that we remain relevant despite the fast-changing business and social climates. Both strategies are given equal importance in Ayala and drives the group to be continually resilient and innovative.

More discussion on non-financial matters can be found in the succeeding pages within the Our Value Creation section.