Full-Year Highlights

• Ayala Corporation’s full year earnings amounted to ₱35.3 billion, including the divestments gains of ₱23.6 billion from AC Education and AC Energy.

• Strong consumer driven revenue growth of ALI, Globe and BPI drove the bottom-line.

• Results tempered by the recognition of a remeasurement loss of ₱18.1 billion for Manila Water.

• Slowdown in AC Industrials resulted in a net loss of ₱2.4 billion.

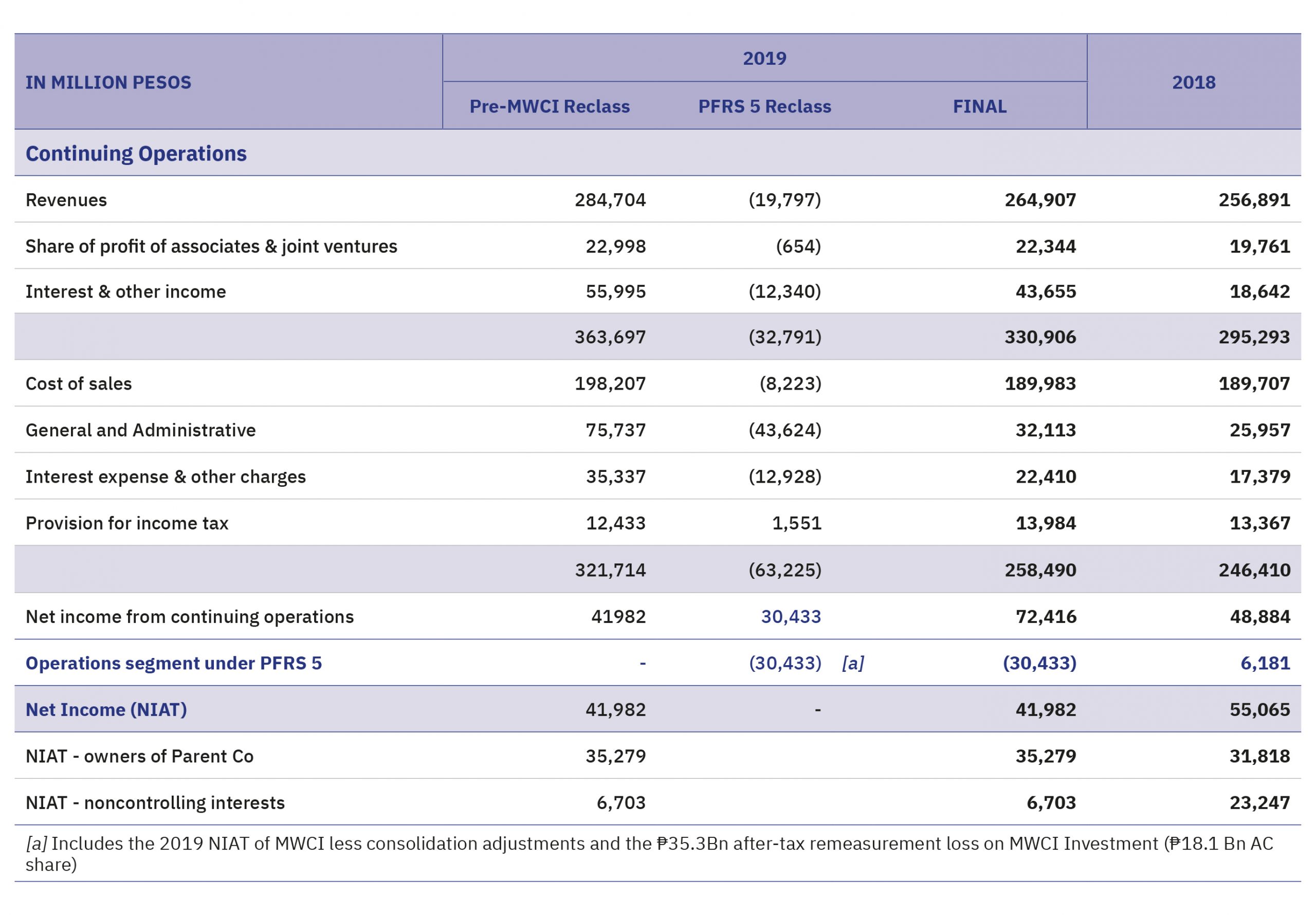

In December 2019, Ayala recognized a remeasurement loss of ₱18.1 billion as a result of the reclassification of its investment in Manila Water as asset held under PFRS 5 (the accounting standard for assets held for sale). This accounting standard requires applying a fair market value accounting for Ayala’s investment in Manila Water, if the completion of the divestment and or subsequent loss of voting control is expected to occur within one year from the date of the financial statement. It also requires the assets and liabilities of MWC to be presented as one line item in the consolidated balance sheet and P&L in 2019 as opposed to line by line consolidation in prior years.

Please see as summary table below showing the effect of accounting for MWC investment under PFRS 5.

Consolidated Sales of Goods and Services

Sale of goods and rendering services rose three percent to ₱264.9 billion on higher revenues from Ayala Land’s sale of commercial lots and office spaces, middle-market residential products, and improved performance of its leasing segments. This was further supported by increments from AC Energy’s retail electricity supply unit and AC Health. However, this was partly offset by AC Industrials’ lower revenues.

Real Estate

The conglomerate’s real estate arm, Ayala Land, saw a 13 percent growth in its bottom-line in 2019, which reached ₱33.2 billion for the year. Meanwhile, its total revenues increased by two percent to ₱168.79 billion from ₱166.25 billion the previous year, mainly supported by office and commercial and industrial lot sales as well as higher contribution of new leasing assets.

Property development revenues was slightly down two percent year-on-year, reaching ₱117.6 billion in 2019. The performance was due to an eight percent decline in residential revenues given the lower contribution of its Ayalaland Premier and ALVEO brands as most of its vertical projects recognized in 2019 were booked in previous periods and are nearing completion. On the other hand, it exhibited growth in office for sale developments and commercial and industrial lots, which rose 12 percent and 46 percent, respectively.

During the year, Ayala Land introduced three new estates and successfully launched ₱158.9 billion worth of property development projects.

On the other hand, commercial leasing saw double-digit growth from all its segments as it expanded 13 percent to ₱39.3 billion during the year. Revenues from shopping centers grew 11 percent to ₱22.0 billion from ₱19.91 billion on the back of sustained growth from its stable malls and increased contributions from its newly opened malls, Ayala Malls Feliz, Capitol Central, and Circuit Makati. Similarly, office leasing revenues increased by 12 percent to ₱9.67 billion from previous year’s ₱8.61 billion, with the new offices in Ayala North Exchange, Vertis North, and Circuit Makati improving the segment’s performance. Revenues coming from hotels and resorts rose by 19 percent to ₱7.62 billion from ₱6.39 billion in 2018 on strong patronage of Seda Ayala Center Cebu and Seda Lio.

Ayala Land expanded its leasing portfolio with malls and offices totaling 2.1 million and 1.2 million square meters of gross leasing area, respectively, and hotels and resorts with 3,705 rooms.

Ayala Land spent a total of ₱108.7 billion in capital expenditures in 2019. Most of the amount supported the construction of residential projects at 40 percent of total. Following this, 26 percent was spent on the company’s rental assets, 17 percent on land acquisition, 14 percent on estate development and the rest on other investments.

Ayala Land, through its subsidiary, AREIT Inc., became the first Philippine company to file a real estate investment trust (REIT) offering to the Securities and Exchange Commission last February 7, 2020. AREIT is seeded with Grade A office assets located in Makati CBD and is expected to expand its portfolio with new acquisitions in the future. Through this initial capital market transaction, Ayala Land hopes to pave the way for the development of a REIT market in the country, bringing another milestone to the Philippine stock market. Ayala Land seeks to do an Initial Public Offering (IPO) of AREIT, Inc. after receiving the regulatory approvals from the SEC and the PSE.

Water

Manila Water’s full-year net profits dipped 16 percent year-on-year to ₱5.5 billion as the water supply shortage in March severely impacted the East Zone concession while some cost-side challenges also weighed down on profitability.

The decline in La Mesa dam water levels caused water service availability to drop significantly, with the dam reaching its lowest level at 68.5 meters in April 2019. To assist severely affected customers, Manila Water implemented a one-time Bill Waiver Program. Additionally, in July, raw water allocation from Angat Dam hit its lowest, with releases limited to 35 cubic meters per second for the MWSS Concessionaires. To mitigate this, Manila Water pushed for network efficiency to maintain service availability by ensuring water service of at least 7 pounds per square inch (psi) of pressure, enough to reach the ground floor level, enabling it to serve more than 7 million people covering over 1.3 million households in the East Zone.

Throughout 2019, Manila Water also affirmed its wastewater commitment of providing 32 percent coverage of the East Zone by 2021. Wastewater coverage in the East Zone is currently over 30 percent, equivalent to two million people served through nearly 400 kilometers of laid sewer network. Wastewater coverage was only at three percent prior to Manila Water taking over operations from MWSS in 1997.

Considering these factors, costs and expenses for the East Zone concession increased 32 percent to ₱6.4 billion for the year, mainly driven by the ₱534 million penalty imposed by MWSS and additional service recovery and operations costs. In all, the Manila concession’s net income for the year was at ₱5.1 billion, a decline of 22 percent from 2018.

In February, Ayala announced a strategic partnership with an infrastructure company of Enrique K. Razon Jr., Prime Metroline Holdings Inc., through a company that it will incorporate for the transaction (hereafter, “Trident Water”), with the acquisition of a 25 percent stake in Manila Water. Ayala remains a shareholder with a 38.6 percent stake. Subsequently, Ayala announced that as part of the shareholder agreement to be executed among Ayala, its wholly owned subsidiary Philwater Holdings Company, and Trident Water, the conglomerate’s Executive Committee approved the grant of proxy rights by Philwater to Trident Water over such number of preferred shares to enable the latter to achieve 51 percent voting interest in Manila Water. Upon the grant of proxy rights to Trident Water, Ayala’s effective voting interest in Manila Water will stand at 31.6 percent. The shareholders’ agreement will become effective after the closing of the subscription agreement, which will occur after certain conditions are met, including required lenders’ consent and regulatory approvals.

Power

Ayala’s more recent core business, AC Energy, registered net profits of ₱24.6 billion in 2019, lifted by contribution from its solar projects in Vietnam, recovery of costs incurred from adjustments in the construction and operations of its power plants, and gains from the partial divestment of its thermal assets. AC Energy increased its attributable energy output in 2019 by 25 percent to 3,500 Gigawatt hours, of which 50 percent came from renewables sources.

As it shifts its portfolio towards renewable energy, AC Energy has a pipeline of more than 1,000MW in various renewable projects in the Philippines and overseas that are expected to reach financial close within 2020. This will bring AC Energy’s renewable energy capacity close to 2,000MW by the end of 2020, in line with its goal of achieving 5,000MW of renewables capacity by 2025.

AC Energy saw several developments that supported its international businesses. The start of operations of the company’s solar farms in Vietnam supported profits during the year. Three plants with a total of 410MW commenced commercial operations in the second quarter, in time to meet Vietnam’s solar feed-in tariff deadline.

AC Energy also announced a joint venture project with UPC Solar Asia Pacific, its existing partner for various projects in and out of the Philippines, for the development of solar projects in the Asia-Pacific region.

In addition, AC Energy and Yoma Strategic Holdings Ltd. also announced its decision to form a 50:50 joint venture to drive the growth of Yoma Micro Power (S) Pte. Ltd., and jointly explore developing around 200MW of additional renewable energy projects within Myanmar including participation in large utility scale renewable projects.

Locally, subsidiary AC Energy Philippines signed share purchase agreements to increase its stakes in the North Luzon Renewables wind project, and the Sacasol and Islasol solar plants. It also started the construction of the 120MW Alaminos solar plant and the 150MW Ingrid peaking plant.

In line with its commitment to scale up its renewable energy investments, AC Energy issued two green bonds in 2019, effectively raising US$810 million in fresh capital to support its pipeline of renewable energy projects. The first issuance, which happened in January-February 2019, was the power company’s maiden green bonds and fetched a total amount of US$410 million. The bonds were the first publicly syndicated Climate Bond Initiative-certified US$ Green Bonds in Southeast Asia. Subsequently in November, AC Energy raised US$400 million through the first ever US dollar denominated fixed-for-life green bond issued globally. The perpetual green bonds were listed on SGX-ST and certified under the ASEAN Green Bonds Standards by the Philippine Securities and Exchange Commission on 18 November 2019.

Industrial Technologies

AC Industrials recorded a net loss of ₱2.4 billion as headwinds in both the electronics manufacturing services industry and the global auto industry hampered earnings across its several business lines.

The company’s EMS platform, Integrated Micro-Electronics Inc., continued to weather challenges in its main market segments, particularly the industrial and consumer spaces. As the automotive sector contracted globally, most notably in China, IMI’s revenues, dropped 17 percent year-on-year. Additionally, investments in capacity and technical capabilities for future growth increased the company’s overhead expenditures, which partly affected gross profit margins. Overall, these factors hindered IMIs growth in 2019, with the company posting a net loss of US$7.8 million for the year.

Revenues from IMI’s wholly owned operations tallied at US$1 billion, down 7 percent from the previous year. The company’s Asian operating units dropped a total of 11 percent, as a function of the aforementioned slowdown in China’s automotive market for the year. This was offset by the performance of IMI Europe, also largely automotive based, which grew three percent year-on-year as the company’s newest production facility in Serbia continued its ramp-up in its first full year of operations. In parallel, IMI’s Mexico operations, which serve the North American markets, continued their robust trajectories with a 50 percent revenue growth in 2019.

IMI’s core subsidiaries, Via Optronics and STI, Ltd., posted combined revenues of $248 million, a decline of 21 percent from the previous year. VIA’s drop was mainly driven by the slump in the overall computing consumer segment and the delay in the release of a new generation component from one of its major customers. Meanwhile, the uncertainty over Brexit, which persisted at least through 2019, caused some delays in the awarding of several contracts where STI is a key competitor.

AC Industrials’ Philippine vehicle distribution and retail arm, AC Motors, recorded a net loss of ₱337 million on lower sales volumes across its Honda, Isuzu, Kia, and Volkswagen brands. As the industry recovers from the previous year’s sizable, policy-driven decline, competition continues to be highly competitive, with over 50 players vying for slowly recovering customer demand.

Meanwhile, AC Industrials’ startup investments, Merlin Solar, MT Technologies, and C-CON, recorded higher net losses during the period as they continue to grow their revenue pipelines, invest in capacity and infrastructure, and manage underutilization of capacity resulting from the global downturn in automotive and manufacturing.

Share in Net Profits of Associates and Joint Ventures

Share in net profits of associates and joint ventures expanded 13 percent to ₱22.3 billion on Globe’s higher revenues and lower non-operating expenses and BPI’s higher interest and non-interest income. This was, however, partly offset by lower earnings from AC Energy’s investee companies.

Banking

BPI’s net earnings, which was supported by solid core income, higher securities trading gains, and steadily growing fee-based businesses, jumped 25 percent to ₱28.8 billion in 2019.

Total revenues grew 20 percent to ₱94.3 billion as both net interest income and non-interest income saw robust growth for the full year. BPI’s net interest income was up 18 percent to ₱65.9 billion on the back of a 9-percent improvement in average asset base and a 24-basis point expansion in net interest margin. Net interest margin increased from 3.11 percent in 2018 to 3.35 percent in 2019, as a result of asset yields rising 69 basis points, partially offset by higher cost of funds.

Total loans grew 9 percent year-on-year, reaching ₱1.48 trillion, primarily driven by consumer loans which grew 13 percent, much faster than corporate and SME loans, which also grew 8 percent and 6 percent, respectively. Total deposits rose 7 percent to ₱1.70 trillion during the year. The bank’s CASA ratio stood at 69.1 percent, while the loan-to-deposit ratio was at 87.0 percent.

Non-interest income was ₱28.4 billion, an increase of 25 percent versus 2018, primarily from higher securities trading gains and fee-based income. Fees, commissions, and other income increased by 12 percent, driven by higher fees from credit cards, transaction banking, branch services, and digital channels.

Operating expenses totaled ₱50.1 billion, higher by 15 percent from the previous year. Cost-to-income ratio was at 53.1 percent, lower than the 55.5 percent recorded in the prior year. Provision for losses for 2019 was ₱5.8 billion, increasing the Bank’s loss coverage ratio to 104.8 percent. NPL ratio improved to 1.66 percent from 1.85 percent in 2018.

The bank’s total assets stood at ₱2.21 trillion, higher by 6 percent year-on-year, with return on assets at 1.38 percent. Total equity amounted to ₱269.6 billion, with a common equity tier 1 ratio of 15.17 percent and capital adequacy ratio of 16.07 percent, both well above regulatory requirements. Return on equity for 2019 was at 10.97 percent.

BPI also issued over ₱3.1 billion of Long-Term Negotiable Certificates of Time Deposit (LTNCTDs) in October 2019. The LTNCDs have a tenor of 5.5 years and an interest rate of 4 percent p.a. In December 2019, BPI Family Savings Bank (“BFSB”), the Bank’s wholly-owned thrift bank and consumer lending unit, issued ₱9.6 billion of 2.5-year bonds with an interest rate of with 4.3 percent p.a.

Telco

Globe’s net income ended at ₱22.3 billion, up 20 percent, boosted by the company’s data-related products and services.

Overall, Globe’s total service revenues were up 12 percent to ₱149 billion, lifted by data-related services, which accounted for 71 percent of the total.

The company’s strategy is aligned to the evident growth in data driven customers across all segments. Mobile data users rose 7 percent to 39.6 million subscribers, which consequently pushed mobile data traffic up substantially by 78 percent to 1.7 petabytes. Likewise, the company’s home broadband subscriber base increased 25 percent to over 2 million customers as Globe Home Pre-paid Wifi gained more traction in its segment. In order to further solidify its foothold in the home broadband space through an expanded portfolio of data offerings, Globe also launched At Home Air Fiber 5G on July 2019.

Globe’s EBITDA ended at ₱76 billion, up 17 percent due to robust service revenues as well as subdued operating expenses. Operating expenses grew a modest eight percent despite higher costs related to marketing, subsidies, and staff as interconnect charges dropped significantly during the period. The company’s EBITDA margin was steady at 51 percent for 2019.

Capital expenditure reached a record-high of ₱51 billion, 18 percent higher year-on-year. This was allocated to fast-tracking network rollout. During the year, Globe put up more sites and added more 3G and 4G base stations.

Costs and Expenses

General and administrative expenses rose 24 percent to ₱32.1 billion, mainly driven by AC Energy’s higher manpower costs, professional fees, and restructuring costs related to the partial divestment of its thermal assets drove the increase. AC Industrials’ manpower and advertising costs as well as AC Health’s clinic network expansion and the consolidation of Generika and Entrego into AC Health and AC Infra, respectively, likewise drove the higher GAE.

Balance Sheet Highlights

The company’s balance sheet remains strong with enough capacity to support its future investments and cover dividend and debt obligations.

At the end of 2019, Ayala’s total assets stood at ₱1.3 trillion. Investment properties expanded 8 percent to ₱246.7 billion on the back of ALI’s malls and office expansion. Investments in associates and joint ventures, meanwhile, ended at ₱246.7 billion on account of higher equity in net earnings contribution of BPI and Globe as well as additional investments made by Ayala Land, AC Health, AC Infra, and AC Ventures.

At the end of 2019, total debt at the consolidated level stood at ₱405.3 billion, two percent lower from its end-2018 level, despite additional borrowings of Ayala Land and AC Energy as MWCI’s total debt of ₱56.4 billion was reclassified to liabilities under PFRS 5.

Ayala’s parent level cash stood at ₱22.6 billion, with net debt at ₱83.2 billion. Ayala’s parent net debt-to-equity ratio stood at 63 percent. The conglomerate’s loan-to-value ratio, the ratio of its parent net debt to the total value of its assets, was at 6.5 percent at the end of 2019.

The consolidated capital expenditure of the group reached ₱215 billion in 2019, mainly driven by Ayala Land and Globe, which respectively tallied ₱109 billion and ₱51 billion in capital outlay for the year. Parent-only capital expenditure, on the other hand, reached ₱30 billion, which went mostly to the newer businesses of Ayala. For 2020, the Ayala Group has programmed ₱275 billion in capital expenditures, of which ₱20.8 billion has been earmarked under the parent to support the emerging businesses in its portfolio.