BUSINESS REVIEW

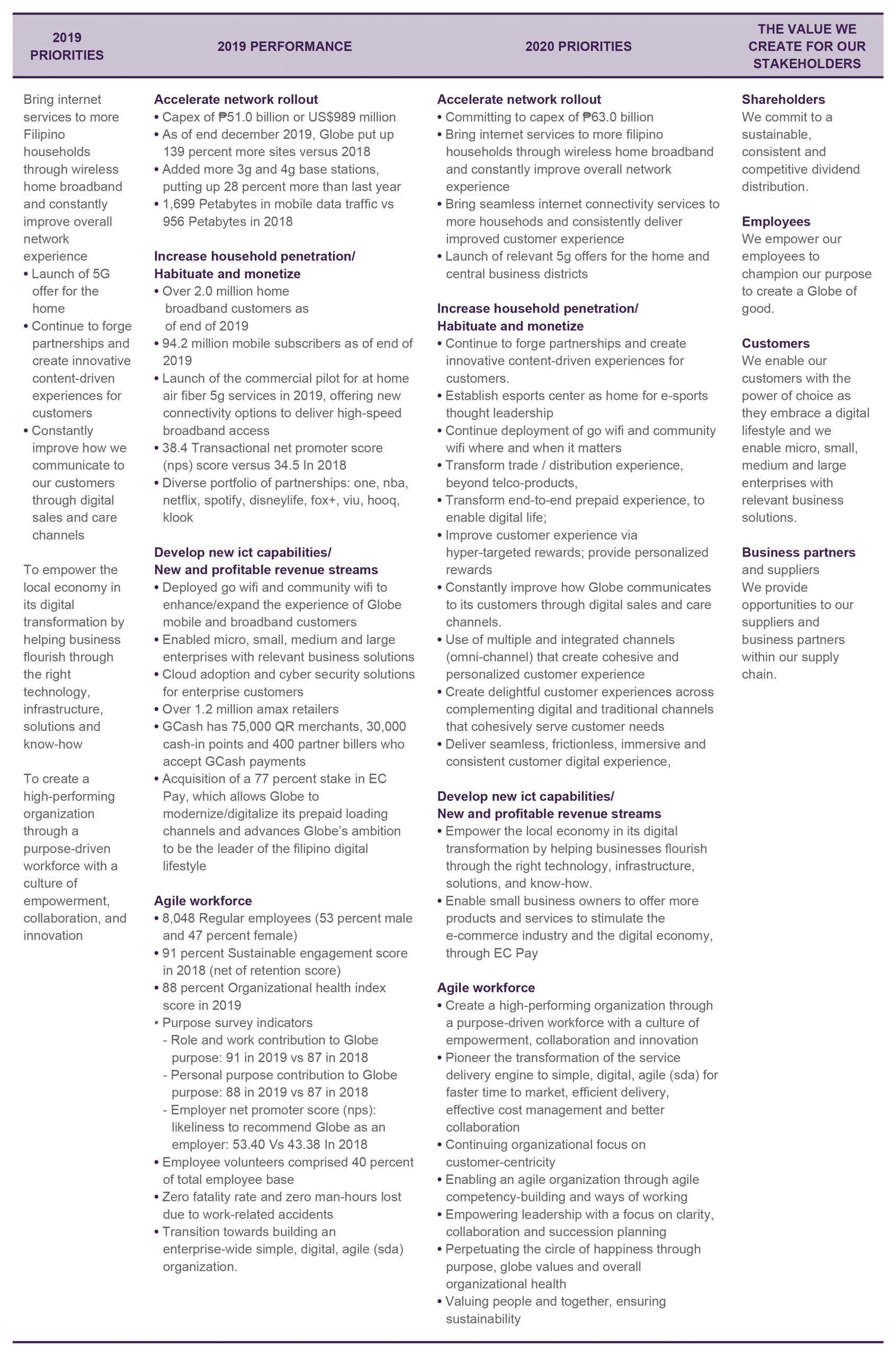

For 2019, Globe’s consolidated service revenues reached ₱149.0 billion, 12 percent higher from a year ago. This growth was fueled by the gains from data services across mobile, broadband and corporate data.

For the mobile business, revenues posted ₱111.8 billion, up 12 percent from a year ago. As the mobile segment dominated the Philippine market, mobile revenues remained the largest revenue contributor, accounting for 75 percent of the total service revenues led by Globe’s prepaid brands. Total mobile subscriber base is now at 94.2 million, up 27 percent from 2018.

From a product perspective, mobile data revenues generated ₱71.8 billion in 2019, 41 percent higher year-on-year, mainly driven by the surging demand for video streaming, gaming apps and social media, further boosted by the compelling promotions for data-centric plans. Mobile data now accounts for 64 percent of mobile revenues from 51 percent a year ago. Mobile data traffic likewise leapt from 956 petabytes in 2018 to 1,699 petabytes in 2019, a 78 percent growth year-on-year.

For the home broadband business, revenues reached ₱21.7 billion this period, up 17 percent from a year ago, driven by a rising level of fixed wireless broadband users, which grew 40 percent to almost 1.4 million in 2019. Total home broadband subscriber base now stands at over 2 million, up 25 percent from a year ago. The rising popularity of Home Prepaid Wi-Fi and compelling broadband plans fueled @Home broadband’s success. The launch of the commercial pilot for At Home Air Fiber 5G services further expanded Globe’s product suite, offering new connectivity options to deliver high-speed broadband access to its broadband customers.

Corporate data revenues reached ₱12.8 billion as of end-December of 2019, up 9 percent from 2018. This was propelled by the higher circuit count coupled with the increase in usage for both internet and domestic services. Revenue levels were also supported by the enterprise clients’ increasing demand for products and solutions to support their digital transformation initiatives.

Supporting these revenue streams, Globe’s total operating expenses including subsidy posted close to ₱73 billion for the period, or an 8 percent increase from a year ago. This led to consolidated EBITDA of ₱76 billion, up 17 percent from 2018.

As a result of the top line growth, which fully covered the increases in operating costs, depreciation charges and non-operating expenses, net income for the period expanded 20 percent to ₱22.3 billion. Core net income, which excludes the impact of non-recurring charges, and foreign exchange and mark-to-market charges, stood at P22.5 billion, 20 percent higher year-on-year.

Globe spent a record level of capital expenditures of ₱51 billion in 2019, 18 percent higher than a year ago. This represents 34 percent of gross service revenues and 67 percent of full year EBITDA. Bulk of the all-time high spend went to data-related requirements as Globe continued to invest in the Philippines towards enabling Filipino families and businesses. This record spend allowed the company to make significant gains and fast-track its network rollout during the year. As of December 2019, Globe put up 139 percent more sites and 28 percent more 3G and 4G base stations compared to its year-ago level.

On the mobile money front, GCash continued to promote financial inclusion and expand the mobile money ecosystem, ending the year with 75,000 QR merchants, 30,000 cash-in points and 400 partner billers who accept GCash payments. On top of the ecosystem expansion, GCash also introduced several innovations in 2019 to further drive engagement, and bring more financial services to the underserved and unbanked markets. One such innovation is GSave, a digital savings account that can be opened straight from the GCash app. Not only does GSave allow first time depositors to participate in the formal banking segment, it also provides a very competitive offer with interest rate of up to four percent interest per annum, with no minimum initial deposit or maintaining balance requirement.