Ayala believes good corporate governance is an important pillar of its operations and is vital to the achievement of its strategic goals, particularly with the increasing focus on digitalization. Ayala is fully committed to upholding the principles of good governance, including transparency, integrity, accountability, fairness and professionalism in all its activities.

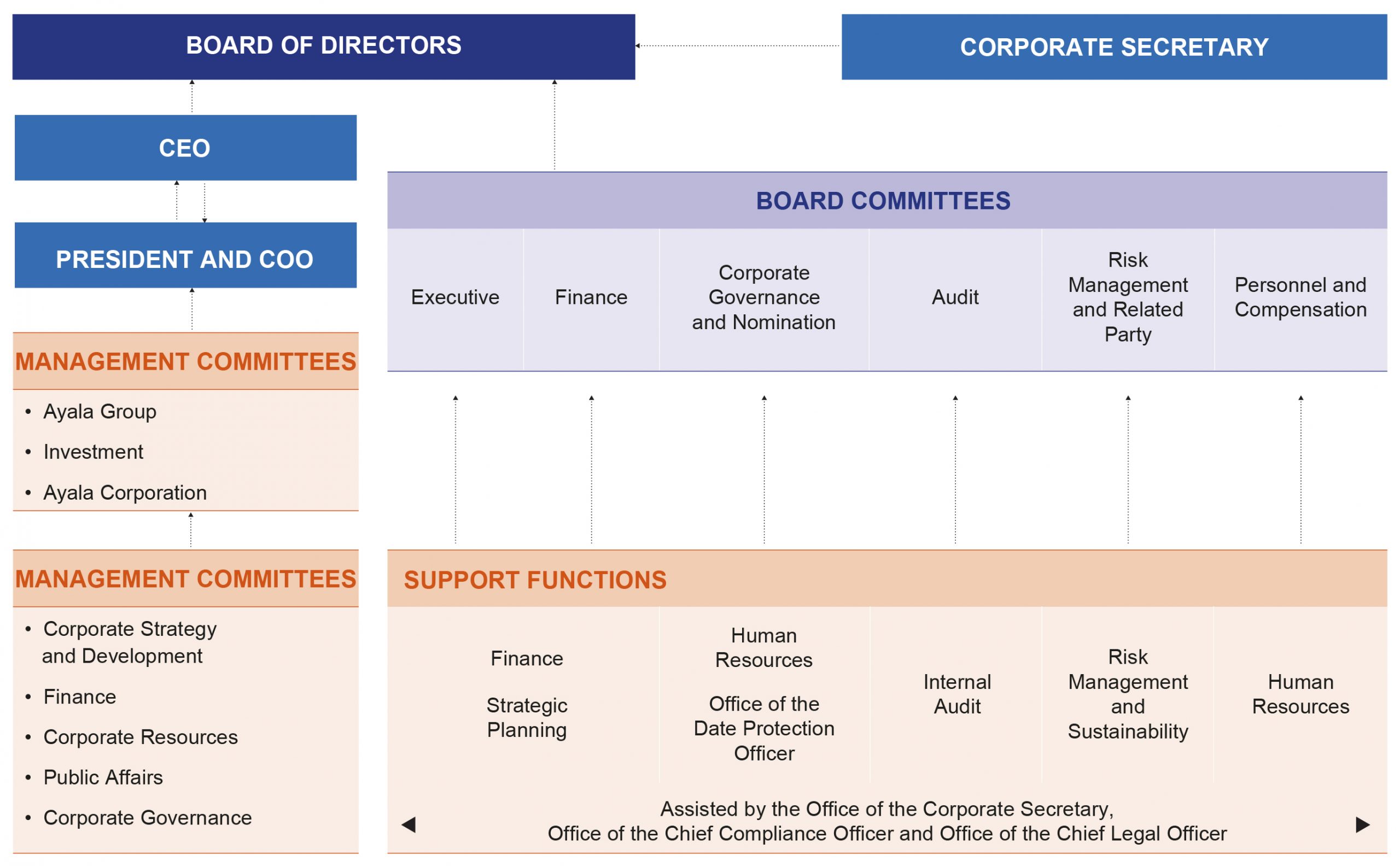

The company’s Corporate Governance System takes into consideration the organizational structure as a whole; led by an effective Board and Board Committees; supported by empowered and accountable Management and Management Committees; guided by strong core values across all levels captured in clear Vision-Mission statements; with sound policies and effective risk management process and internal controls system.

Further, the company’s governance system ensures the protection of its shareholders and their right to participate and vote in stockholders’ meeting through the Committee of Inspectors of Proxies and Ballots, a committee created by the board but composed of non-directors. The Committee is tasked with validation of proxies and tabulation of votes for shareholders’ meetings.

Ayala is constantly reviewing, evaluating and improving its governance structures, systems, and procedures, to be able to meet the changing expectations of regulators, investors and other stakeholders. Setting up an effective risk management process and adequate internal controls system while complying with regulatory requirements and international standards allow the company to create a sustainable enterprise for the long term.

KEY COMPONENTS OF AYALA’S GOVERNANCE SYSTEM

Ayala’s corporate governance practices have been consistently recognized in various awards, polls, and publications in the Philippines and in the ASEAN region. For more details on awards, please refer to page 213-214.

COMPLIANCE WITH THE CORPORATE GOVERNANCE CODE

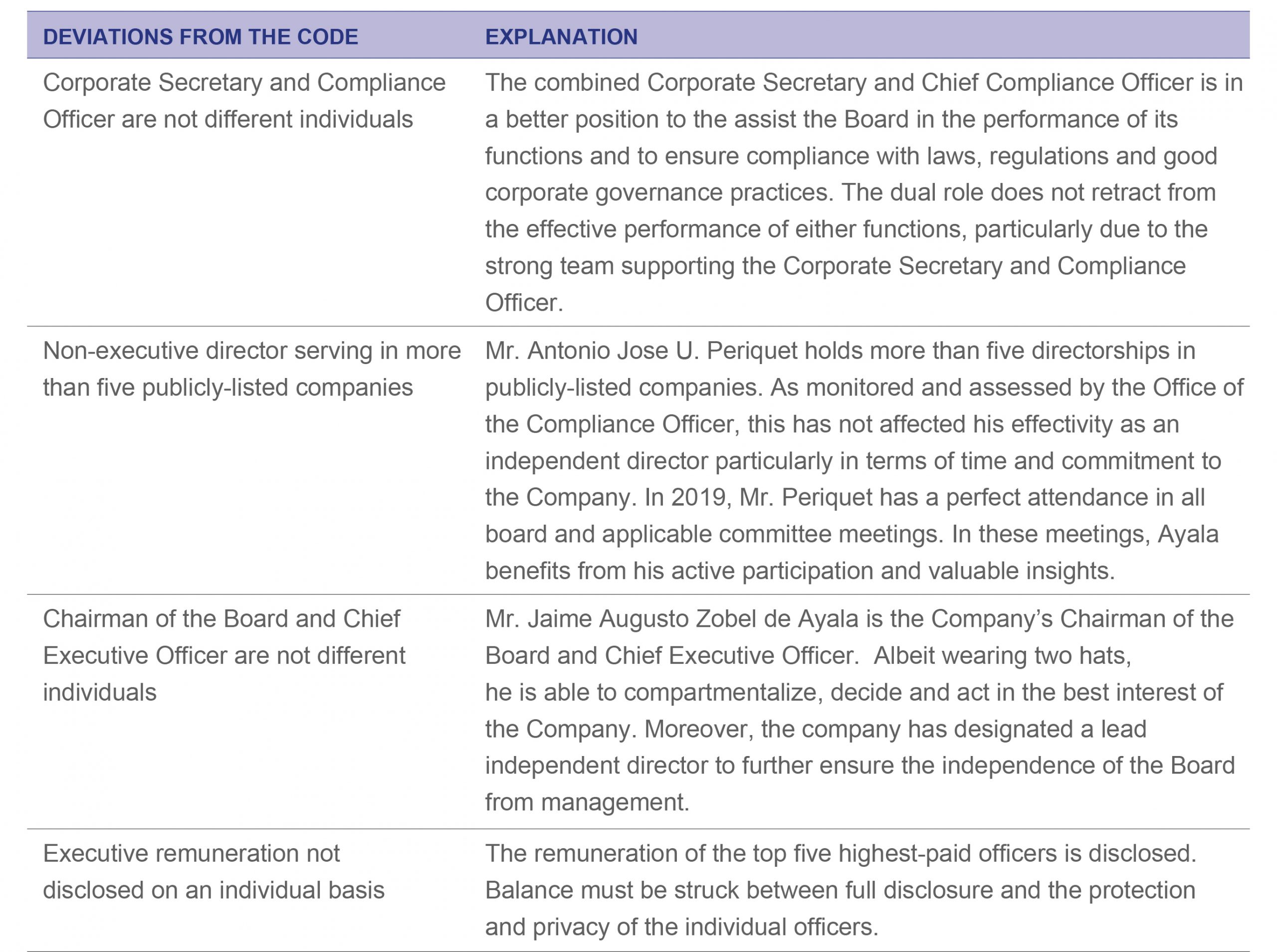

Ayala complies with the Code of Corporate Governance for Publicly Listed Companies set forth by the Securities and Exchange Commission (SEC), except for the deviations provided in the table below.

This compliance is supported by an attestation from the company’s Chief Executive Officer, Chief Compliance Officer, and Chief Audit Executive for the year 2019.

BOARD OF DIRECTORS AND MANAGEMENT

Roles and Responsibilities

A culture of good governance is fostered throughout the organization, with the management and the Board equally responsible for ensuring that adequate mechanisms and structures for good governance are in place and working effectively.

Board of Directors

The Board has the responsibility to oversee the affairs of the corporation, act on behalf of the company as a whole and be accountable to all shareholders. It is part of the Board’s responsibility to select and appoint senior management, and assess their performance in accordance with the process and criteria set in the Corporate Governance and Nomination Committee Charter.

A more thorough discussion on the board of directors can be found on pages 31-42.

Management

Management is responsible to the Board of Directors for the operations of the company and its performance, and informs the Board in a regular and timely manner about any issues concerning the company’s strategy, risk management, and regulatory compliance.

Chief Executive Officer and President/Chief Operating Officer

The respective roles of the CEO and the President/COO are complementary and ensure a strategic distribution of leadership functions with clearly defined accountabilities:

• The CEO takes the lead on company strategy, visioning, and developing business partnerships.

• The President/COO is responsible for daily operations, new business initiatives, corporate policies, and resource allocation.

In all functions and critical issues, both coordinate closely with each other. The CEO and the President/COO are supported by management committees composed of key executives who meet regularly to discuss business performance and issues critical to the operations and growth of the company, and to facilitate the flow of strategic and operational information among the company’s decision-makers.

Corporate Secretary and Chief Compliance Officer

The company’s Corporate Secretary and Chief Compliance Officer is Atty. Solomon M. Hermosura. He is legally trained, knowledgeable on legal and regulatory requirements and has kept abreast on relevant developments by taking on a part time role in teaching graduating law students, attending executive development programs and participating as a speaker in various public fora. He has also attended various corporate governance trainings, including Ayala’s Integrated Corporate Governance, Risk Management and Sustainability Summit.

As Corporate Secretary, part of his responsibilities includes assisting the Chairman in preparing the Board meeting agenda, maintaining Board minutes and records, facilitating the training of directors, and providing directors with updates on relevant statutory and regulatory changes. The appointment and removal of the Corporate Secretary is subject to the approval of the Board.

As Chief Compliance Officer, his functions include, among others, identification and management of compliance risks, ensuring the company’s adherence to sound corporate governance best practices, and monitoring, reviewing, evaluating and ensuring compliance by the corporation, its officers and directors with relevant laws, rules and regulations, including the Code of Corporate Governance for Publicly Listed Companies and other governance issuances of regulatory agencies.

Related to these functions, Atty. Hermosura is also the company’s Group Head of Corporate Governance and Chief Legal Officer.

INTERNAL GOVERNANCE MECHANISMS

Accountability and Audit

External Auditors

The Audit Committee has the primary responsibility to recommend the appointment and removal of the external auditor. The external auditors are directly accountable to the Audit Committee in helping ensure the integrity of the company’s financial statements and financial reporting process. Their responsibility is to assess and provide an opinion on the conformity of the audited financial statements with Philippine Financial Reporting Standards and the overall quality of the financial reporting process. The Audit Committee oversees the work of the external auditors and ensures that they have unrestricted access to records, properties, and personnel to enable performance of the required audit.

During the Annual Stockholders’ Meeting last April 26, 2019, the shareholders re-appointed Sycip Gorres Velayo and Co. (SGV & Co.) as the company’s external auditor for the year 2019, with Lucy L. Chan as the lead engagement partner.

The Committee met with the external auditors without the presence of the management team to discuss any issues or concern. To ensure that the external auditor maintains the highest level of independence from the company, both in fact and appearance, the Audit Committee approved all audit, audit-related, and permitted non-audit services rendered by the external auditor. Non-audit services expressly prohibited by regulations of the SEC were awarded to other audit firms to ensure that the company’s external auditor carries out its work in an objective manner.

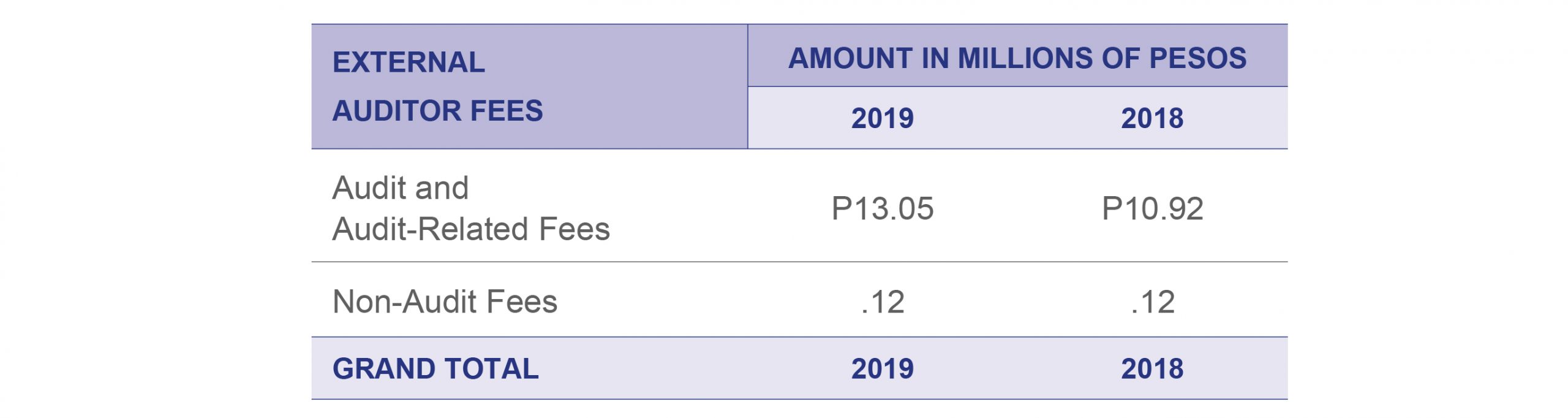

Total fees billed by SGV & Co. for the years ended December 31, 2019 and 2018 amounted to ₱13.17 million and ₱11.04 million, respectively, inclusive of VAT. The Audit Committee reviewed the nature of non-audit services rendered by SGV & Co. and the corresponding fees, and concluded that these are not in conflict with their function as the company’s external auditor. The breakdown of the fees for 2019 and 2018 are shown below:

Audit and Audit-Related Fees include the audit of Ayala’s annual financial statements and the mid-year review of financial statements in connection with the statutory and regulatory filings or engagements for the years ended 2019 and 2018. These also include assurance services that are reasonably related to the performance of the audit or review of Ayala’s financial statements pursuant to the regulatory requirements. Non-Audit Fees include special projects / consulting services.

There were no disagreements with the company’s external auditor on any matter of accounting principles or practices, financial statement disclosures, or auditing scope or procedures.

Internal Auditors

Internal Audit supports the Audit Committee in the effective discharge of its oversight role and responsibility. The Chief Audit Executive, Catherine H. Ang, reports functionally to the Audit Committee of the Board of Directors, and administratively to the President and Chief Operating Officer or his designate. The activities of Internal Audit are governed by a separate Internal Audit Charter approved by the Audit Committee and the Board.

Internal Audit adopts a risk-based audit approach in developing its annual work plan, which is reassessed quarterly to consider emerging risks. The Audit Committee reviews and approves the annual work plan and all deviations therefrom and ensures that internal audit examinations cover the evaluation of adequacy and effectiveness of controls encompassing the company’s governance, operations, and information systems; reliability and integrity of financial and operational information; safeguarding of assets; and compliance with laws, rules, and regulations. The Committee also ensures that audit resources are adequate and reasonably allocated to the areas of highest risk, including the effectiveness of the internal audit function. During the year, the Committee regularly met with the Chief Audit Executive without the presence of management to discuss any issues or concern.

To strengthen corporate governance, Ayala’s Internal Audit adopted portfolio-based subsidiary oversight to standardize the implementation of good practices and ensure that critical issues are monitored and addressed across the Ayala group.

As of 2019, the audit team has an average of 13.4 years audit experience and an average of 4.3 years tenure in the Ayala group. The audit team has the following certifications and professional affiliations: certified public accountants, certified internal auditors, certified fraud examiner, certified information systems auditor, certified foreign exchange professional, crisis communication planner; certified in ISO 9001, ISO 22301, ISO 27001, IT Infrastructure Library, COBIT 5 (F), and Global Innovation Management Institute Level 1; a member of the Financial Executives of the Philippines; and a Fellow of the Institute of Corporate Directors. All the internal auditors are also members of The Institute of Internal Auditors Philippines and adopt the International Professional Practices Framework promulgated by The Institute of Internal Auditors, Inc.

In November 2019, the Internal Audit Unit engaged an External Quality Assessment Review (EQAR) to be conducted by PricewaterhouseCoopers. As a result, Internal Audit continues to maintain the “Generally Conforms” rating from the 2014 external review. The rating, considered the highest possible score for the EQAR, demonstrates that the Internal Audit’s activities continue to conform to the International Standards for the Professional Practice of Internal Auditing and are continuously evaluated through an independent Quality Assessment Review conducted every five years.

Ayala Group Internal Auditors’ Network (AGIAN) continues to perform activities that strengthen synergistic collaboration within the group. Regular meetings are held by the AGIAN Council and the four AGIAN Circles to discuss activities that will enable effective teamwork, increase collaboration, sharing of resources, and best practices within the group. In November 2019, in lieu of its annual conference, the Ayala group internal auditors volunteered for Project Kasibulan. A total of 61 internal auditors from across the group volunteered 2,196 hours and planted 1,210 seedlings for a total of 3,406 volunteer hours for the Project 185th Volunteer Program in support of Ayala’s renewed commitment to help improve Filipino lives as the company celebrates its 185th year in business.

Quarterly technical sessions were also held to provide the members with the knowledge, tools and required auditing skills to enable them to perform their responsibilities. Since 2018, AGIAN has partnered with The Institute of Internal Auditors Philippines to accredit the quarterly AGIAN trainings for Continuing Professional Development for renewal of licenses and certifications. This is in addition to the continuing training and development programs, from specific job skills to long-term professional development provided by the respective companies of the group to their employees.

In lieu of its annual conference, AGIAN volunteered for Project Kasibulan.

DISCLOSURE AND TRANSPARENCY

Accurate and Timely Disclosures

Emphasis is given on providing quality, accurate, and timely disclosures to regulators and the investing public, including information on the results of its operations and financial performance. Ayala created procedures for internal reporting to ensure consistency in providing the investing public with prompt disclosures on significant and market sensitive information that may affect their investment decisions. Policies and procedures are also in place to ensure the company’s compliance with disclosure requirements under the listing rules of the SEC, Philippine Stock Exchange (PSE), and Philippine Dealing and Exchange Corporation (PDEx).

Investors, analysts, and media were engaged by Ayala through conducting meetings and quarterly briefings, where the senior management discusses the results of the company’s operations with investment and financial analysts. More details on management’s discussion and analysis of financial condition and results of operations are available on pages 217-222.

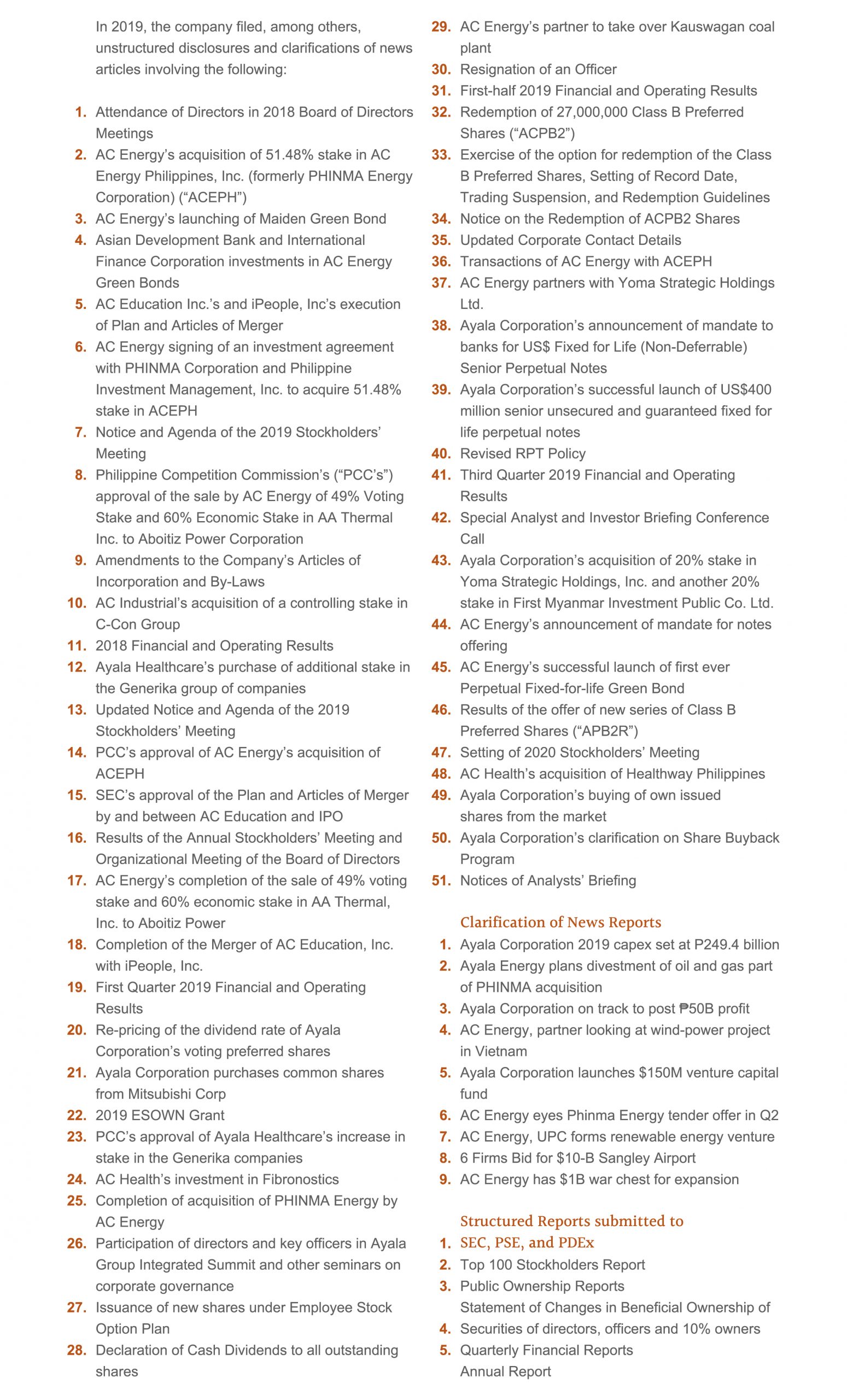

All relevant disclosures were filed in a timely manner with the SEC, PSE, and PDEx. All the 2019 filings and relevant information were provided ahead of time, details as follows:

• On April 11, 2019, the Annual Report (SEC Form 17-A) together with the consolidated audited financial statements for 2018 were submitted to the SEC, within 120 days after year-end.

• On March 21, 2019, the Notice of the Annual Stockholders’ Meeting with a detailed explanation of the Agenda items was released to the SEC and PSE, 36 days ahead of the scheduled annual meeting on April 26, 2019.

• On March 22, 2019, the audited financial statements as contained in the Definitive Information Statement were submitted to the SEC and PSE, 35 days before the annual stockholders’ meeting.

• Interim or quarterly financial statements and results of operations were submitted to the regulators within 45 days from the end of the financial period.

This information, past annual reports, and this Integrated Report and the consolidated audited financial statements are disseminated to shareholders through the company’s website at www.ayala.com.ph and through media and analysts’ briefings.

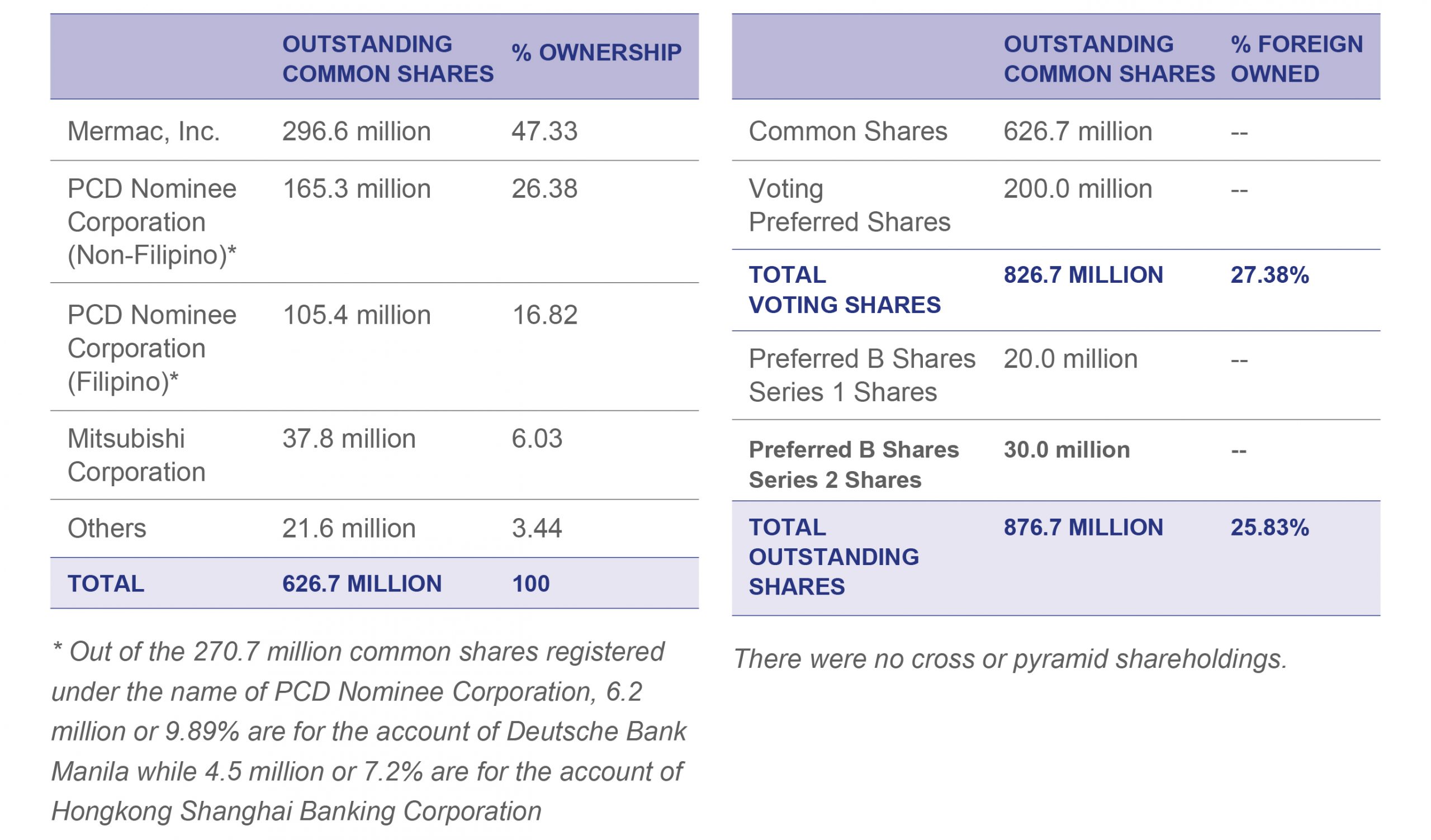

Ownership Structure

As of December 31, 2019, Ayala’s outstanding common shares were held as follows:

2019 Disclosures

Financial and Non-Financial Reports

The Board of Directors has a responsibility to the shareholders to ensure the integrity of the company’s consolidated financial statements and non-financial information disclosed in the company’s Integrated Report. The financial statements comply with the Philippine Financial Reporting Standards, with significant accounting judgments and estimates also disclosed. Nonfinancial performance was prepared in line with the guiding principles and content elements of the Integrated Reporting framework and referred to the Global Reporting Initiative (GRI) Standards 2016 to report the sustainability performance.

A more comprehensive disclosure on both financial and non-financial performance indicators are thoroughly discussed in the Integrated Report to help shareholders understand the company’s various businesses and their impact on the company’s overall value creation. Refer to pages 217-222 and 89-124 for the financial and non-financial performance indicators, respectively.

Related Party Transactions

In dealing with related party transactions (RPTs), Ayala is governed by its policy to ensure that the transactions are at arm’s length, fair, and will inure to the best interest of the company and all its shareholders. The RPTs are transactions involving a transfer of resources, services or obligations between the company and a related party as defined in the policy, regardless of whether a price is charged. As per policy, all SEC defined and company recognized material RPTs shall be reviewed by the Risk Management and Related Party Transactions Committee and approved by the Board before its commencement, except transactions that are explicitly exempted by the SEC and transactions the review of which are delegated to management. SEC defined material RPTs are transactions amounting to ten percent or higher of the Corporation’s total assets based on its latest audited financial statements while company recognized material RPTs are transactions that meet the threshold values – P50 million or five percent of the total assets of either party, whichever is lower. These transactions are discussed and quantified in the Notes to the Consolidated Financial Statements under Related Party Transactions, which are made available on the company’s website.

There were no RPTs classified as financial assistance to entities other than wholly-owned subsidiaries. There were also no cases of non-compliance with the laws, rules, and regulations pertaining to significant or material RPTs in the past three years.

CODE OF CONDUCT AND ETHICS

The Code of Conduct and Ethics was established by the Board to guide all directors, officers, and employees in executing their roles and responsibilities. As the overall governing body, the Board ensures that all directors, officers, and employees of the company adhere to the Code.

All the company’s directors, officers and employees are expected to avoid situations of conflicts of interest or impropriety and those who have personal or pecuniary interest on any RPT are required to fully disclose the relevant facts of the situation to ensure that potential conflicts of interest are reported and brought to the attention of management, whether actual or apparent. Management is responsible for enforcing and monitoring compliance with the Code and imposing sanctions for violations thereof.

It is the policy of Ayala that all directors, officers, and employees shall conduct business in accordance with Philippine Laws and regulations, including Anti-Money Laundering Law. Employees shall consult with the Corporate Governance Officer and Chief Legal Officer whenever there is any doubt concerning the legality of any matter. Any suspected criminal violations will be reported to the appropriate authorities and non-criminal violations will be investigated and addressed as appropriate.

Anti-Corruption Policy

Ayala is committed to doing its business with the highest ethical standards and has adopted a zero-tolerance policy towards fraud, corruption, bribery in any form, and all unethical practices, and is committed to complying with all relevant laws and standards. The Anti-Corruption Policy embodied in the Code provides guidance to all directors, officers, and employees on how to conduct business in a fair, ethical, and legal manner. It must be strictly observed in all their transactions and dealings with customers, suppliers and business partners of the company as well as with the government.

The company has also set guidelines for dealing with gifts and gratuities to protect the integrity of its employees and its business interests. Seeking undue financial and material advantage from any transaction is strictly prohibited. Any offer or gift of value given to directors, officers, and employees, or their immediate family, with a view to get favors or to influence business recommendations are immediately reported to the appropriate reporting level. Directors, officers, and employees are likewise instructed not to accept gifts or invitations of any form, except when it meets the criteria set by the company. The policy also applies even if the offer or bribe is made through another person.

INSIDER TRADING POLICY

To protect shareholders, Ayala defined a policy against insider trading of company securities and non-disclosure of material non-public information to any person until the information is disseminated to the public and two full trading days had lapsed from the disclosure thereof. The Policy ensures compliance with disclosure rules and prevention of the unlawful practice of using confidential information to one’s own benefit.

Trading Blackout

The Policy prohibits trading in Ayala’s shares by all company directors, officers, consultants, and employees, including their immediate family members living in the same household, who may have knowledge of material non-public information about the company during trading blackout periods. They are also required to submit annually a certification of compliance with the prohibition against trading.

For structured disclosures, the blackout period commences from five trading days before and ends two trading days after the disclosure of quarterly and annual financial results. For non-structured disclosures, blackout period is two trading days after the disclosure of any material information other than quarterly and financial results.

During the year, notices of trading blackouts were regularly disseminated and issued to all personnel via e-mail. Compliance was strictly enforced during these trading blackout periods.

There have been no violations of the company’s insider trading and trading blackout policies in the past three years.

Reporting of Transactions

Ayala has established and implemented guidelines for all directors, officers, employees and consultants on reporting trades. All directors and officers from Managing Directors and above, the Comptroller, Chief Audit Executive, Chief Risk Officer, Treasurer, Chief Compliance Officer, Corporate Secretary, and Assistant Corporate Secretary must report to the company all acquisitions or disposals, or any changes in their shareholdings in the company within three business days from the transaction date. All other officers and employees must submit to the Chief Compliance Officer a quarterly report on their trades of company securities.

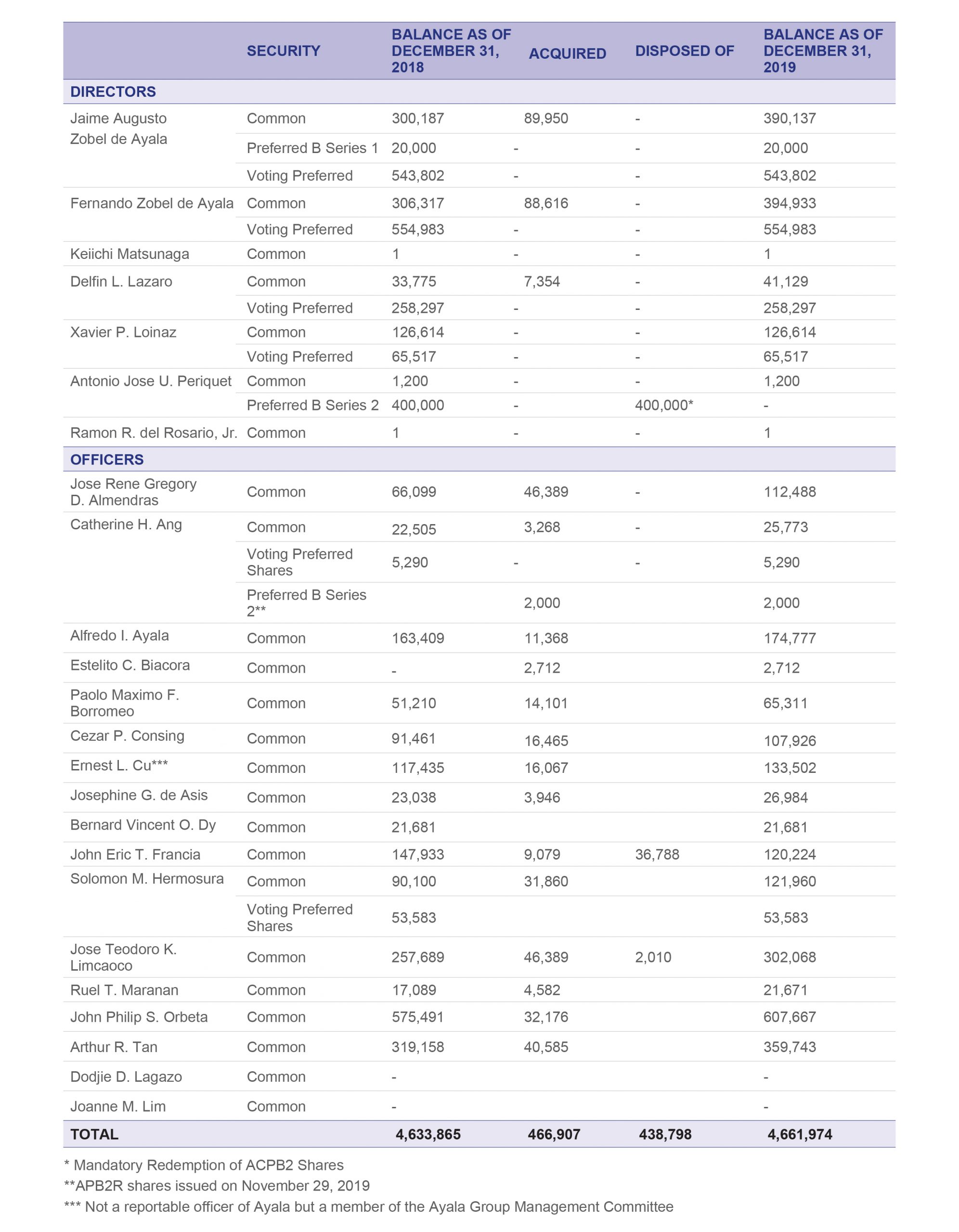

A schedule showing the changes in shareholdings of the directors and officers in 2019 is disclosed in the next page.

WHISTLEBLOWER POLICY

In pursuit of integrity, Ayala strives to enhance the level of transparency within the company through the establishment of the Whistleblower Policy to encourage directors, officers, employees and all suppliers, business partners, contractors and subcontractors, and other third parties to report any perceived wrongdoing or malpractice involving the company or its personnel. The policy is meant to encourage the reporting of such matters in good faith, with utmost confidence that the whistleblower will be treated fairly and protected from reprisal, harassment, disciplinary action, or victimization for whistleblowing.

To further strengthen integrity, objectivity, and confidentiality, including ensuring the protection of the whistleblower, Ayala has implemented an outsourced receipt and processing of whistleblower reports to Punongbayan and Araullo through the reporting channel https://proactivehotline. punongbayan-araullo.com/report/ayalacorporation. The website allows anonymous reporting and is accessible anytime and anywhere via internet. Status of all reports are trackable with available monthly reports.

The whistleblower may still choose to submit a written report directly to the Office of the Chief Compliance Officer, or by e-mail to whistleblower@ayala.com.ph, or through a face-to-face meeting with any member of the Disclosure Committee composed of one representative each from the Office of the Chief Legal Officer, Strategic Human Resources, Internal Audit, and Group Risk Management.

There is an established Disclosure Committee and investigation process for reported violations of company policies, rules and regulations. All reports are treated in confidence and discussed with the Audit Committee, which monitors the resolution and closure of all reports.

In 2019, there were no incidents reported through Ayala Corporation’s whistleblower reporting channels.

CHANGES IN SHAREHOLDINGS

Reported trades in Ayala Securities of the directors and officers in 2019:

DATA PRIVACY POLICY

As part of its continuing commitment to uphold the data privacy of all stakeholders, Ayala’s Data Privacy Office headed by the Data Protection Officer, Atty. Solomon M. Hermosura works closely with all the business units to regularly review the physical, technical and organizational measures adopted by the Company for the protection of personal data. This is to ensure the integrity, confidentiality and availability of the personal data that the Company collects and processes, and protect these against natural and human dangers, such as accidental loss or destruction, unauthorized access, fraudulent misuse, and unlawful alteration.

In 2019, the Company: (1) continued its legal gap assessment to identify and execute the necessary data sharing and outsourcing agreements with relevant parties, (2) issued its Personal Data Protection Statement for Employees to better inform them of their rights as data subjects, (3) conducted capacity building activities to Ayala Group employees to ensure their strict compliance with the Data Privacy Act of 2012 and other relevant issuances of the National Privacy Commission, and (4) initiated the preparation of the Data Privacy Compliance Dashboard to easily update its personal data inventory and monitor the different aspects of processing of personal data. There were no reported data privacy breaches for Ayala during the year.

Inquiries or concerns regarding data privacy or data subjects’ rights may be communicated in writing directly to the Office of the Data Protection Officer, or by email to acdataprivacy@ayala.com.ph.

WEBSITE

Information on the company’s corporate governance initiatives, this Integrated Report, and all other relevant information is available on the company’s website at www.ayala.com.ph. As part of our stakeholder engagement, Ayala also maintains social media accounts at Facebook.com/AyalaCorporation and https://ph.linkedin.com/company/ayala-corporation.

In lieu of its annual conference, AGIAN volunteered for Project Kasibulan.

REPORTS TO THE BOARD OF DIRECTORS

REPORT OF EXECUTIVE COMMITTEE TO THE BOARD OF DIRECTORS

For the year ended 31 December 2019

The Executive Committee is mandated to exercise the powers and perform the duties of the Board within the authority granted to them. It acts by majority vote of all its members during the intervening period between scheduled Board meetings. In 2019, the Committee deliberated, reviewed and approved the following transactions:

• Funding for the upgrade and expansion of Vermosa Sports Hub;

• Investment in Redeemable Cumulative Preference Shares of AC Industrials Singapore;

• Upstreaming of Proceeds from the Partial Divestment of AC Energy’s Thermal Assets;

• Selection of MCX Expressway Partnership Programme Partner;

• Bridge Financing for IMI (Singapore) Pte. Ltd. through Investment in Redeemable Preference Shares;

• Issuance of up to USD500 Million Guaranteed Undated Notes by AYC Finance Ltd.;

• Revised Related Party Transactions Policy; and

• Investment in Yoma Strategic Holdings, Inc. and First Myanmar Investment Public Co. Ltd.

March 12, 2020.

REPORT OF FINANCE COMMITTEE TO THE BOARD OF DIRECTORS

For the year ended 31 December 2019

The Finance Committee oversees the Corporation’s financial policy and strategy, including capital structure, dividend policy, and capital allocation decisions. In 2019, the Committee accomplished

the following:

1. Discussed, deliberated on and approved the following:

a. Investment in Redeemable Cumulative Preference Shares of AC Industrials Singapore;

b. Buyback of AC Shares from Mitsubishi Corporation;

c. Exercise of Call Option on the Corporation’s Class B Series 2 Preferred Shares

and Reissuance of the Same Shares;

d. Investment in Active Fund by AC Ventures Holding Corp. and AC Industrial Technology Holdings, Inc.;

e. Investment in Yoma Strategic Holdings, Inc. and First Myanmar Investment Public Co. Ltd.;

f. Additional Investment Outlets and updating of bank credit lines as well as counterparty limits;

g. Issuance of up to USD500 Million Guaranteed Undated Notes;

h. Bridge Financing for IMI Singapore through Investment in Redeemable Preference Shares;

i. Additional Equity Infusion into AC Energy, Inc.;

j. Shift of ACIFL’s investment to ACE Thermal SG; and

k. Additional capital allocation to Ayala Healthcare Holdings, Inc.

2. Discussed updates on the Corporation’s exchangeable bond which matured already.

3. Conducted a portfolio review o the Corporation, its affiliates and associates.

March 12, 2020.

REPORT OF THE CORPORATE GOVERNANCE AND NOMINATION COMMITTEE TO THE BOARD OF DIRECTORS

For the year ended 31 December 2019

The Corporate Governance and Nomination Committee is tasked with ensuring that good corporate governance principles and practices are complied with and observed by the company. In line with this mandate, the Committee met four times and accomplished the following in 2019:

• Reviewed the qualifications of all persons nominated to positions requiring appointment by the Board.

• Approved the final list of nominees for directors for election at the 2019 annual stockholders’ meeting after ensuring that all nominees to the Board have met all the qualifications and none of the disqualifications as set forth in the Corporation’s By-Laws, Revised Manual of Corporate Governance and the rules of the Securities and Exchange Commission.

• Approved the final list of nominees for Chairpersons and Members of the Board Committees, Lead Independent Director and key officers at the 2019 organizational board meeting after ensuring that all nominees to the Board have met all the qualifications and none of the disqualifications as set forth in the Corporation’s By-Laws, Revised Manual of Corporate Governance and the rules of the SEC.

• Reviewed, evaluated and approved changes in the criteria for promotions to the Senior Managing Director level.

• Reviewed, evaluated and approved Senior Executive promotions.

• Endorsed for Board approval the engagement of Aon as external facilitator for the Board assessment.

• Reviewed and endorsed for Board Approval the revision of the Insider Trading Policy.

March 12, 2020.

REPORT OF THE AUDIT COMMITTEE TO THE BOARD OF DIRECTORS

For the year ended 31 December 2019

The Board-approved Audit Committee Charter defines the duties and responsibilities of the Audit Committee. In accordance with the Charter, the Committee assists the Board of Directors in fulfilling its oversight responsibilities to the shareholders with respect to the:

• Integrity of the Company’s financial statements and the financial reporting process;

• Appointment, remuneration, qualifications, independence and performance of the external auditors and the integrity of the audit process as a whole;

• Effectiveness of the system of internal control;

• Performance and leadership of the internal audit function; and

• Company’s compliance with applicable legal and regulatory requirements.

In compliance with the Audit Committee Charter, we confirm that:

• The Chairman and another member of the Committee are independent directors;

• We had four (4) regular meetings and executive meetings with the internal auditors and external auditors;

• We have recommended for approval of the Board and endorsement to the shareholders the reappointment of SGV & Co. as the Company’s 2019 external auditor and the related audit fee;

• We have reviewed and discussed the quarterly unaudited consolidated financial statements and the annual audited consolidated financial statements of Ayala Corporation and Subsidiaries, including the Management’s Discussion and Analysis of Financial Condition and Results of Operations and the significant impact of new accounting standards, with management, internal auditors and SGV & Co. We also reviewed and discussed the annual Parent Company Financial Statements. These activities were performed in the following context:

– Management has the primary responsibility for the financial statements and the financial reporting process; and

– SGV & Co. is responsible for expressing an opinion on the conformity of the Ayala Corporation’s audited consolidated financial statements with the Philippine Financial Reporting Standards.

• We have approved the overall scope and the respective audit plans of the Company’s internal auditors and SGV & Co. We have reviewed the adequacy of resources, the competencies of staff and the effectiveness of the auditors to execute the audit plans ensuring that resources are reasonably allocated to the areas of highest risks. We have also discussed the results of their audits, their assessment of the Company’s internal controls, and the overall quality of the financial reporting process including their management letter of comments. Based on the assurance provided by the internal audit as well as SGV & Co. as a result of their audit activities, the Committee assessed that the Company’s system of internal controls, risk management, compliance, and governance processes are adequate;

• We have evaluated the performance of the Chief Audit Executive and the effectiveness of the internal audit function, including compliance with the International Standards for the Professional Practice of Internal Auditing;

• We have reviewed and approved all audit, audit-related and non-audit services provided by SGV & Co. to Ayala Corporation and the related fees for such services. We have also assessed the compatibility of non-audit services with the auditors’ independence to ensure that such services will not impair their independence;

• We have conducted an annual assessment of our performance, in accordance with Securities and Exchange Commission guidelines, and confirmed that the Committee had satisfactorily performed its responsibilities based on the requirements of its Charter; and

• We have reviewed the Audit Committee Charter and Internal Audit Charter to ensure that it is updated and aligned with regulatory requirements.

Based on the reviews and discussions undertaken, and subject to the limitations on our roles and responsibilities referred to above, the Audit Committee recommends to the Board of Directors that the audited consolidated financial statements be included in the Annual Report for the year ended December 31, 2019 for filing with the Securities and Exchange Commission and the Philippine Stock Exchange. We are also recommending the reappointment of SGV & Co. as Ayala Corporation’s external auditor and the related audit fee for 2020 based on their performance and qualifications.

March 06, 2020.

REPORT OF THE RISK MANAGEMENT AND RELATED PARTY TRANSACTIONS COMMITTEE TO THE BOARD OF DIRECTORS

For the year ended 31 December 2019

The Risk Management and Related Party Transactions Committee assists the board in fulfilling its oversight mandate with respect to risk governance and related party transactions. Its objectives are to ascertain that there exists a sound risk management framework and supporting infrastructure within the company, as well as to ensure that all related party transactions are pursued in the best interest of its shareholders.

The Committee held seven meetings in 2019, during which, it:

• Reviewed management’s adopted risk management framework and its ongoing programs to promote risk awareness within the company.

• Reviewed its Committee charter and risk governance policies, including those for enterprise-wide risk, crisis management and related party transactions.

• Evaluated and recommended for approval proposed investments, advances and leases involving related parties.

• Identified sources of downside risk and their possible effects on the company.

March 02, 2020.

REPORT OF PERSONNEL AND COMPENSATION COMMITTEE TO THE BOARD OF DIRECTORS

For the year ended 31 December 2019

The Personnel and Compensation Committee is mandated to establish a formal and transparent procedure for the development of an executive renumeration policy and for determing the remuneration packages of corporate officers and directors, in a manner that is consistent with the company’s culture, strategy, and control environment; and aligned with the long-term interests of the company and its stakeholders, while remaining competitive against the market.

The Committee met two times in 2019 and accomplished the following:

• Reviewed the special report prepared by Willis Towers Watson Singapore on the competitiveness of the current executive compensation program design and remuneration levels of senior executives and management across the Ayala Group of Companies. The benchmarking exercise covered market data from leading companies across Southeast Asia including the Philippines;

• Reviewed and endorsed for Board approval the 2018 performance bonus multiples and 2019 merit increase guidelines for the employees of the Corporation;

• Reviewed and endorsed for Board approval the compensation actions for the Chief Executive Officer and Chief Operating Officer including their performance bonus for 2018, merit increase for 2019 and 2019 ESOWN award; and

• Reviewed and endorsed for Board approval the 2019 Employee Stock Ownership Plan (ESOWN).

March 04, 2020.