WHO WE ARE

AC Industrial Technology Holdings Inc. is Ayala’s industrial technologies arm, managing a primarily mobility-oriented portfolio composed of both operating units and investments in emerging high potential technologies. The company is founded on its dual core of Integrated Micro-Electronics, Inc., a Philippine electronics manufacturing services pioneer and now a globally leading manufacturing and technology solutions partner, and AC Motors, one of the country’s largest multi-brand vehicle distribution and dealership groups. AC Industrials operates in twelve countries around the world with its primary markets in North America, Europe and Asia.

Through AC Industrials, Ayala envisions growing its presence in the global industrial technologies space by capitalizing on opportunities opened by disruptive technological shifts, changing industry landscapes, and evolving end-user demand.

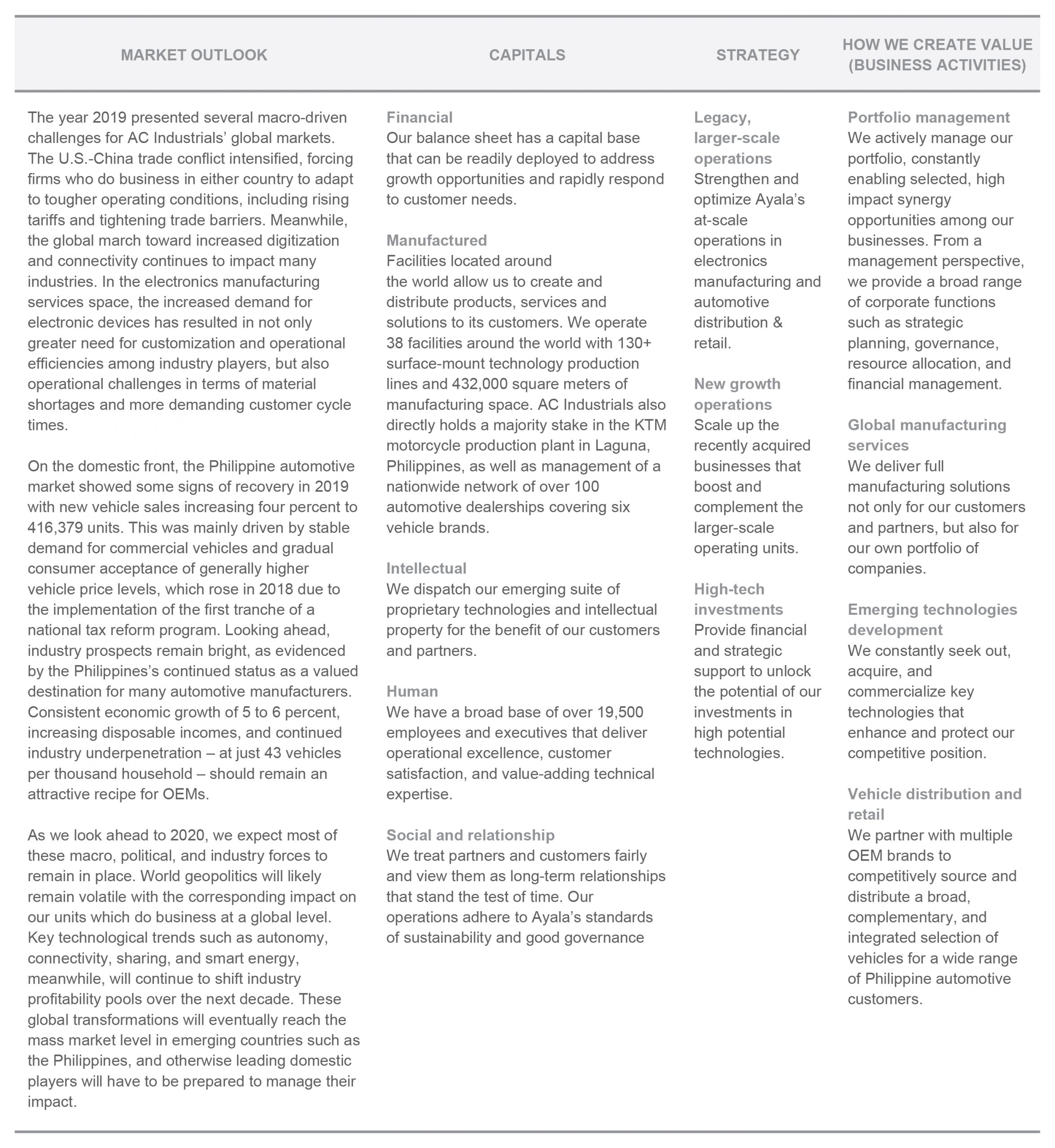

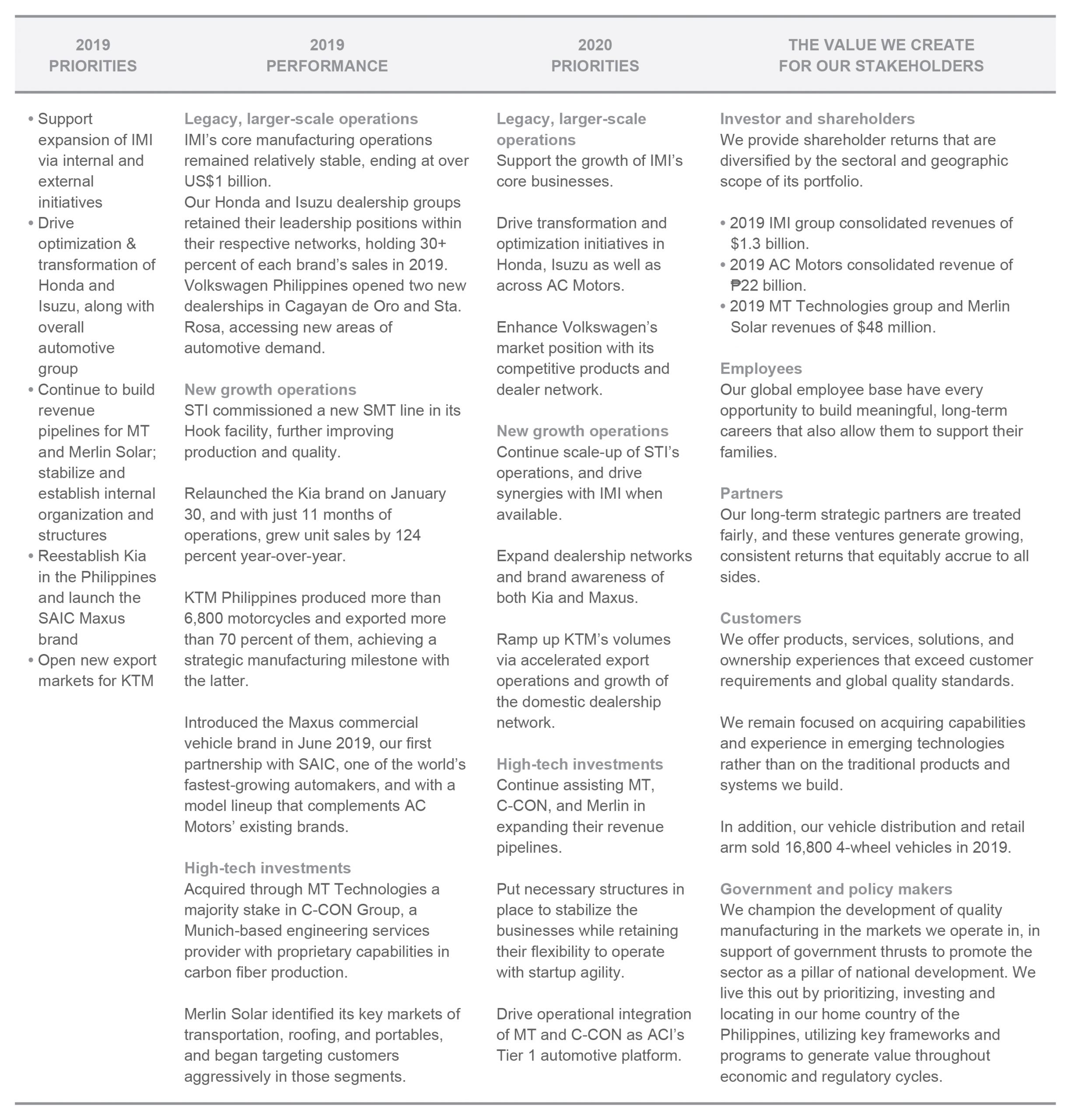

MARKET OUTLOOK

The year 2019 presented several macro-driven challenges for AC Industrials’ global markets. The U.S.-China trade conflict intensified, forcing firms who do business in either country to adapt to tougher operating conditions, including rising tariffs and tightening trade barriers.