WHO WE ARE

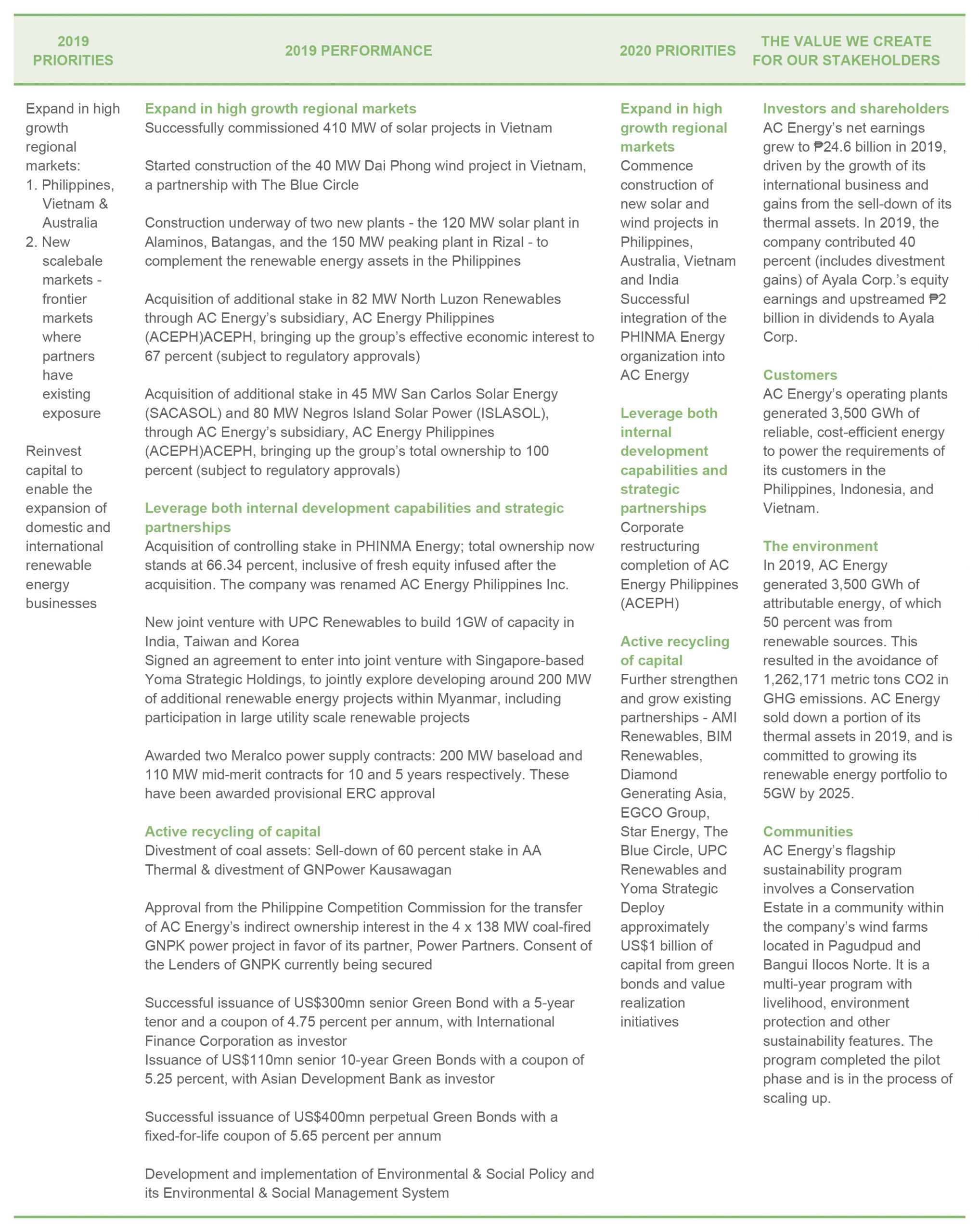

AC Energy’s energy portfolio registered an attributable capacity of over 1.8 GW in operation and under construction in the Asia-Pacific region as of the end of 2019. It increased its attributable energy output in 2019 by 25 percent to 3,500 GWh, of which 50 percent came from renewable energy sources.

As it shifts its portfolio towards renewable energy, AC Energy has developed a pipeline of 1,200 MW in various renewable projects that are expected to reach financial close within 2020. This is in line with the company’s goal of achieving 5,000 MW of attribultable renewable capacity by 2025.

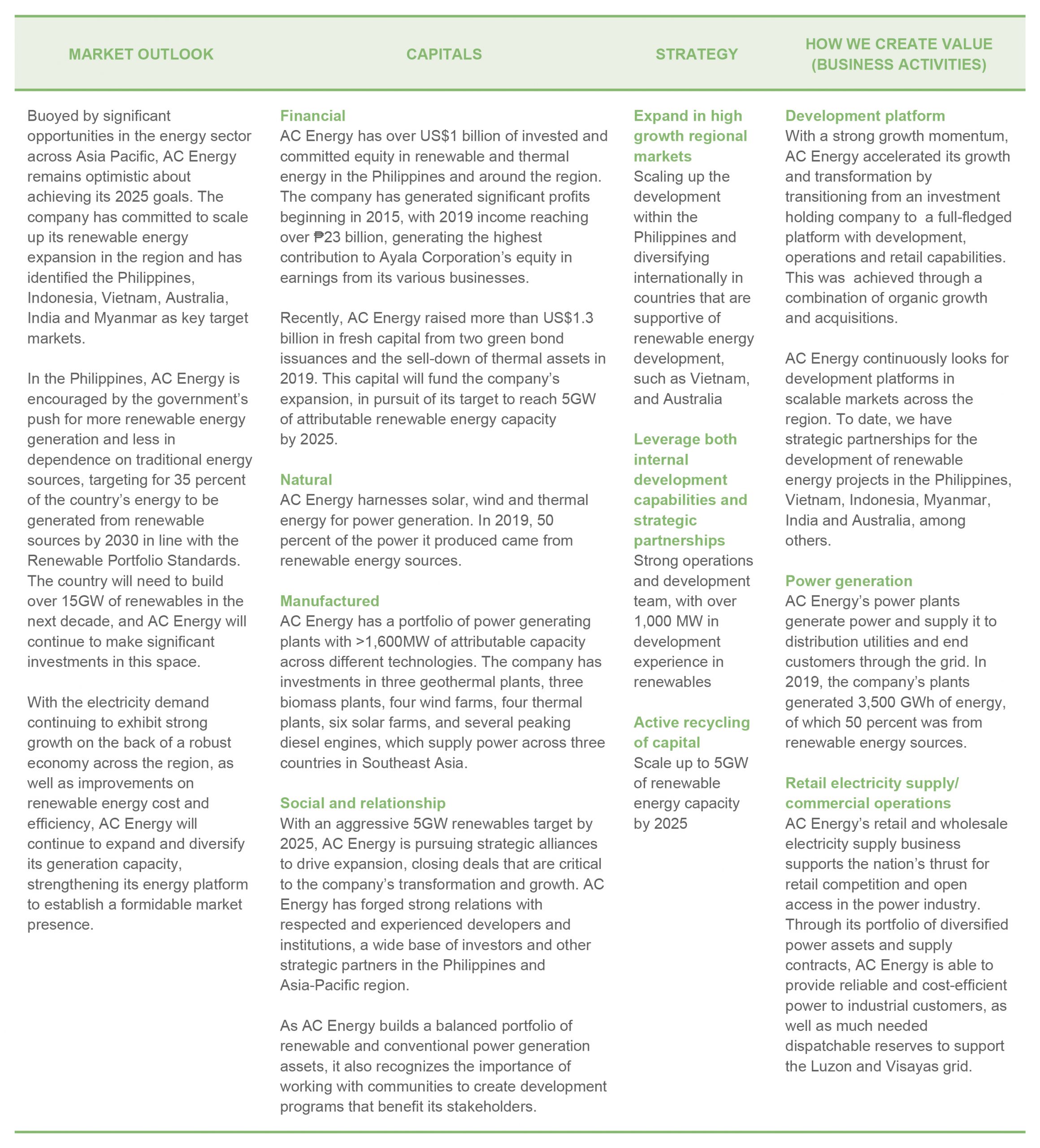

MARKET OUTLOOK

Buoyed by opportunities in the energy sector across Asia Pacific, AC Energy remains optimistic in achieving its 2025 goals. The company has committed to scale up its renewables in the region and has identified the Philippines, Indonesia, Vietnam, Australia, India and Myanmar as key target markets.

In the Philippines, AC Energy is encouraged by the government’s push for more renewable energy generation and less on traditional energy sources. Under the Renewable Portfolio Standards, the country aims to generate 35 percent of total energy output from renewables by 2030. To achieve this, the country will need to build over 15GW of renewables in the next decade. AC Energy, for this part, will continue to make significant investments in this space.

With electricity demand growing on the back of robust regional growth and improvements in attributable renewable energy cost and efficiency materializing, AC Energy seeks to establish significant market presence by expanding and diversifying its generation capacity.

BUSINESS REVIEW

The year 2019 saw AC Energy sustain its growth, with net earnings reaching ₱25.4 billion. This was lifted by contribution from its solar projects in Vietnam, recovery of costs incurred from adjustments in the construction and operations of its power plants, and gains from the partial divestment of its thermal assets.