WHO WE ARE

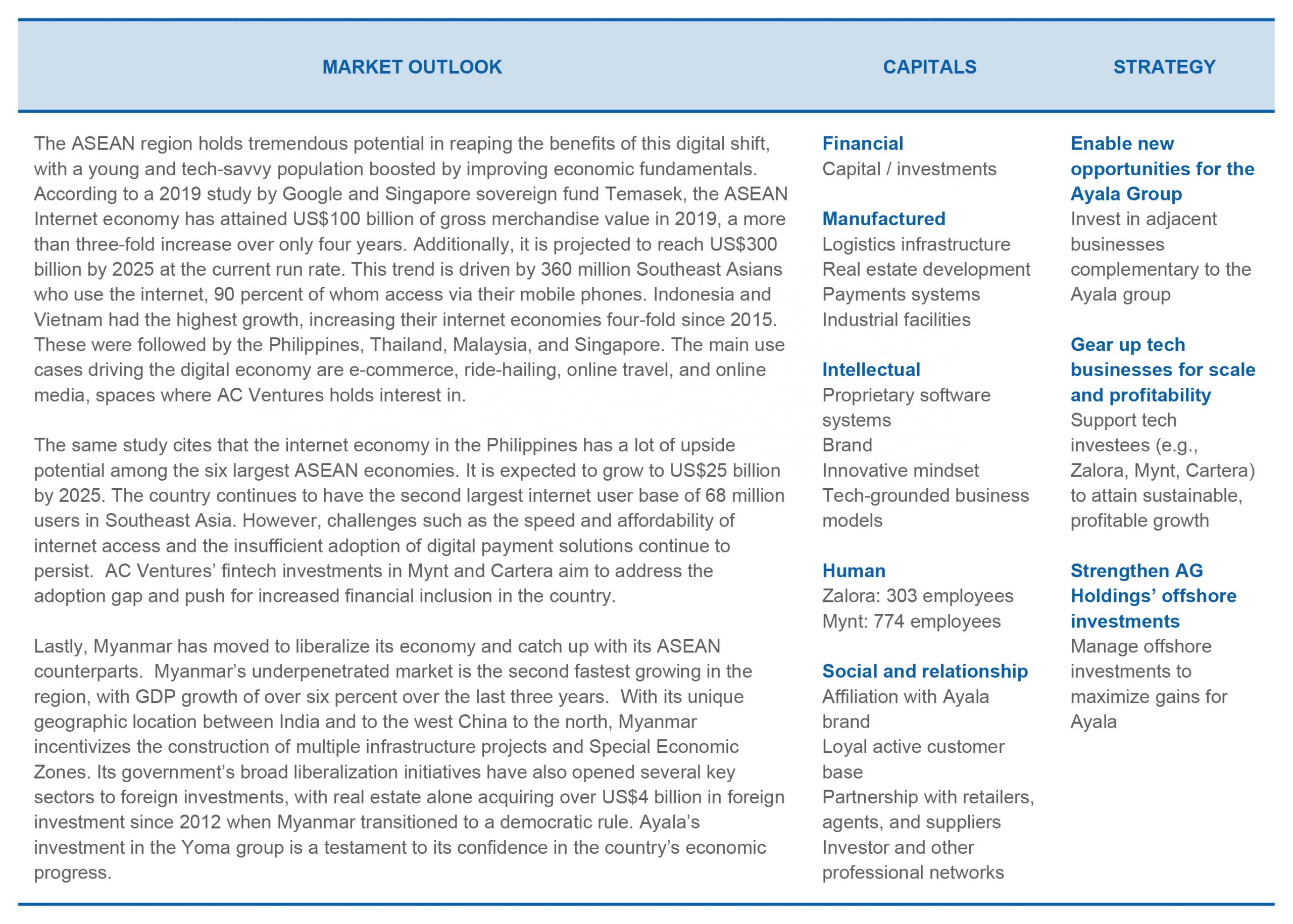

The world has continued to experience tremendous digital transformation, opening up new business opportunities to provide better products and services that would be simpler and more accessible to a broader consumer market. Digitalization and interconnectivity have integrated man and machine, the physical and the virtual, boosting capabilities and efficiencies and disrupting the way industry incumbents are doing things. Big data, artificial intelligence, machine learning, edge computing, and Internet-of-Things are some of the technology trends that could disrupt existing industries, some of which Ayala has presence in already. AC Ventures aims to lay the foundation for Ayala amid the fast pace at which disruptive changes are taking place. It is Ayala’s platform for peeking into new technologies and business models that are relevant to Ayala.

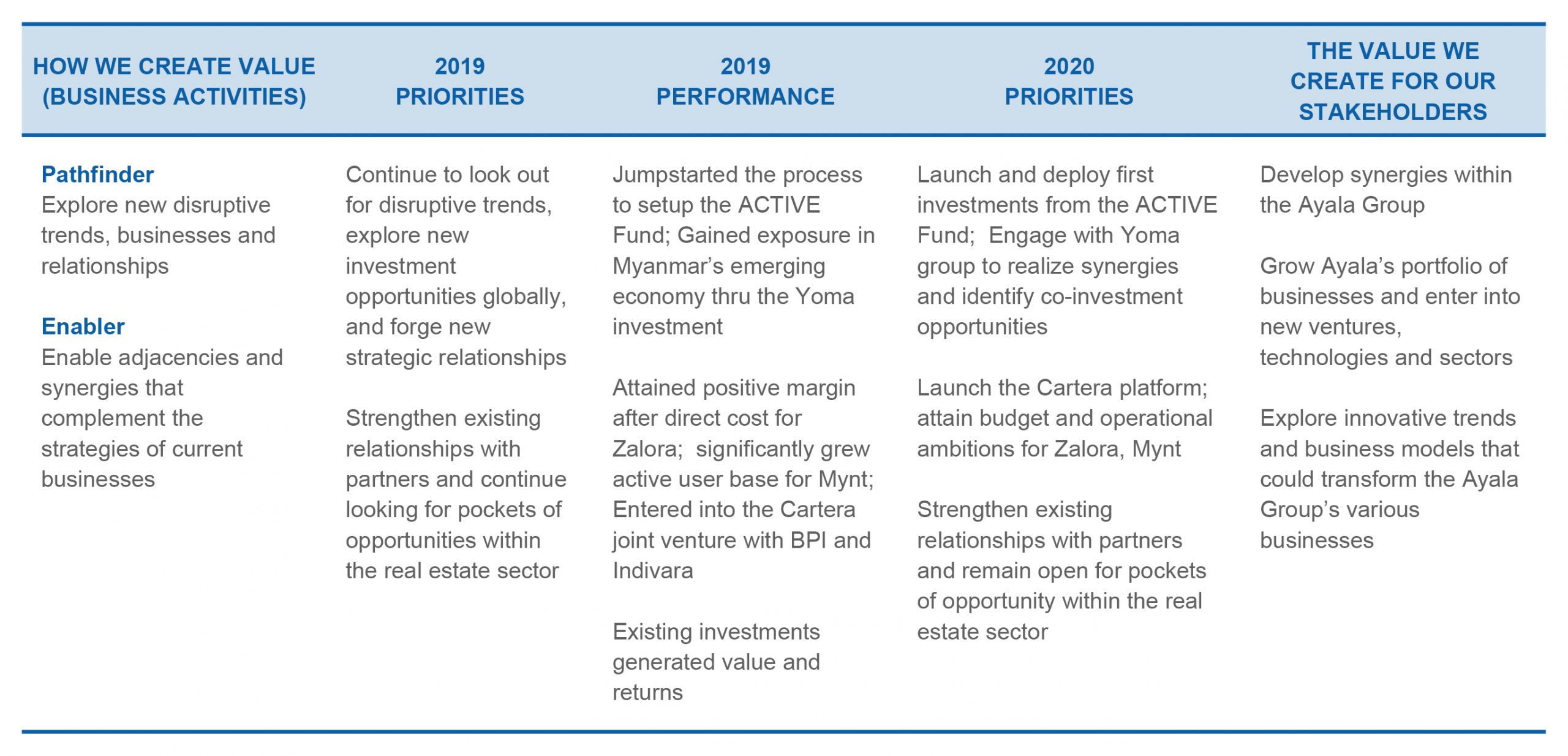

AC Ventures brings together Ayala’s various strategic investments. It aims to be an enabler by investing in adjacent businesses that are complementary to Ayala’s existing business units and a pathfinder by investing in new sectors, emerging trends, and innovative businesses. Through AC Ventures, Ayala intends to embrace disruptive technologies and business models as it endeavors to grow its existing businesses and explore new business verticals. In 2019, AC Ventures together with various Ayala group business units, set up a US$195 million fund called Ayala Corporation Technology Innovation Venture Fund or ACTIVE Fund. The fund is advised by Globe’s corporate venture capital firm, Kickstart Ventures.

AC Ventures holds a 43.9 percent stake in Zalora Philippines, the largest fashion and lifestyle ecommerce platform in the country as well as a 7.6 percent stake in Mynt, a fintech venture with Globe and Ant Financial of the Alibaba Group that operates the fast-rising digital wallet GCash. In 2019, AC Ventures in partnership with BPI and the Indivara Group of Indonesia invested in fintech platform Cartera Exchange.

Further, AC Ventures oversees Ayala’s offshore investments through AG Holdings. Over the past several years, AG Holdings has served as Ayala’s vehicle for its investments in the US and Asia as well as its interests in private equity and real estate funds, property co-investments, and technology business ventures. In 2019, Ayala made its first significant foray into Myanmar through AG Holdings, investing US$237.5 million for a 20 percent stake in diversified conglomerate Yoma group.