WHO WE ARE

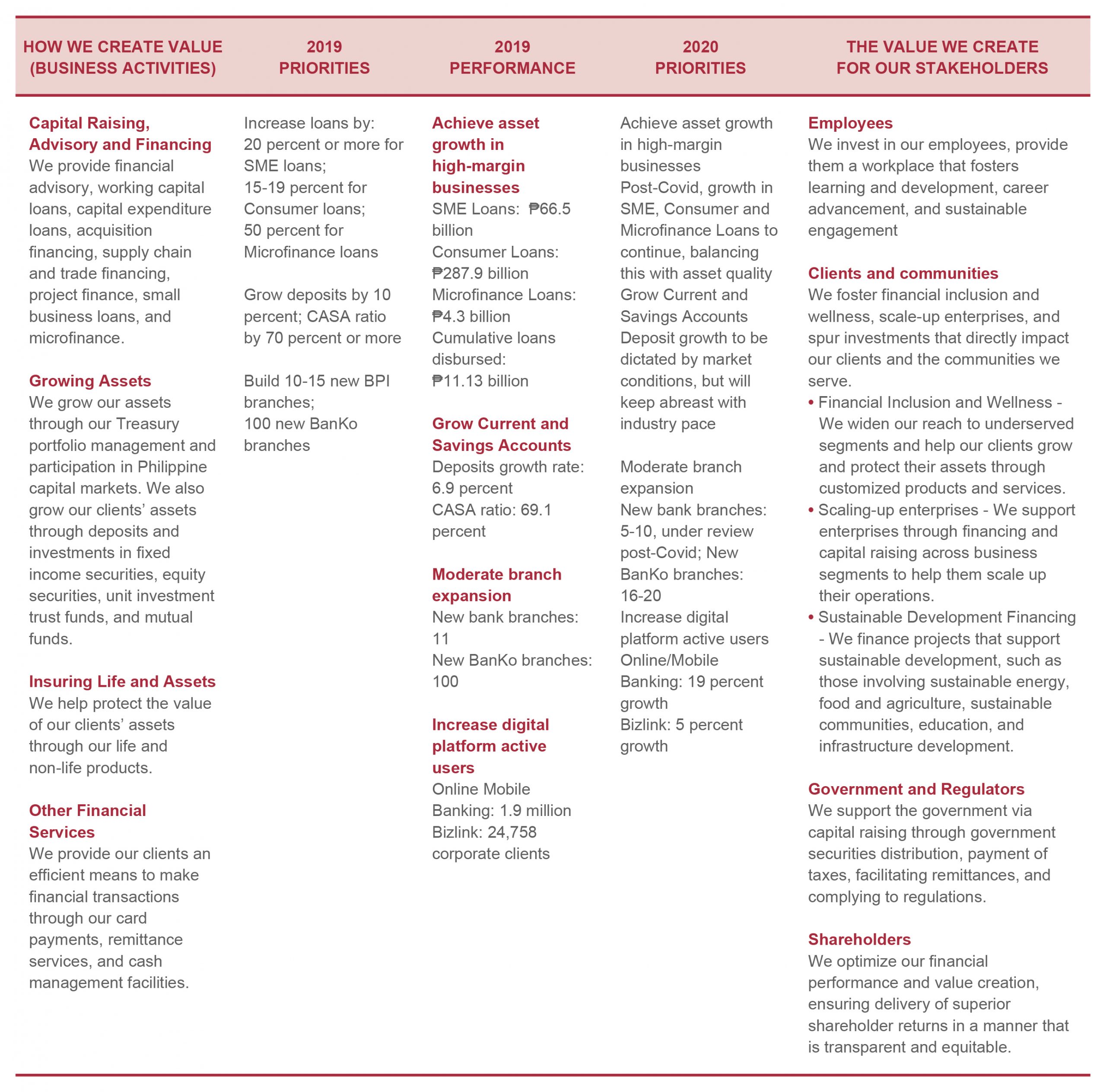

The 168-year-old Bank of the Philippine Islands is the first bank in the Philippines and Southeast Asia, and is licensed by the Bangko Sentral ng Pilipinas to provide universal banking services to its 8.7 million customers. The Bank provides trusted advice and financial services tailored to the needs of its diverse client base of retail and corporate clients, including self-employed micro-entrepreneurs, overseas Filipinos and their beneficiaries, small and medium enterprises, domestic conglomerates, and multinational corporations.

A premier institution in the banking industry, BPI is among the highest in terms of total assets, equity capital, and market capitalization. It has a significant share of total banking system deposits, loans, and investment assets under management. It is recognized as one of the country’s top providers of foreign exchange, cross-border remittances, life and non-life bancassurance services, as well as asset finance and leasing. BPI also has a significant capital markets presence, particularly in fixed income and equities underwriting, distribution and brokerage.

BPI serves its clients through one of the most extensive physical and digital distribution networks, composed of 1,167 branches and branch-lite units, three international offices, and 2,822 ATMs and Cash Accept Machines (CAMs) nationwide. The Bank is a leader and innovator in the use of digital channels, and is a major provider of financial services for retail clients through internet banking (via BPI Online at www.bpi.com.ph) and mobile banking (via BPI Mobile app), and for corporate clients via Bizlink.

MARKET OUTLOOK

The Philippine economy expanded 5.9 percent in 2019, below the 6 to 7 percent target of the government. Despite the strength of household consumption, delays in the implementation of infrastructure projects and the decline in investment spending dragged growth below the 6 percent level. For 2020, the COVID-19 outbreak has become the greatest challenge for the global and domestic economies. It is clear that the outbreak will have a negative impact on the economy. However, quantifying the potential impact of COVID-19 on the Philippine economy is difficult given the uniqueness of the event.